Pharmaceutical generics, formulations and neutraceutricals

Alkem Laboratories

Founded in 1973

Headquartered in Mumbai, Maharashtra

Sectors - Pharma

Listed in -December 2015

NSE Ticker - ALKEM

BSE Ticker - 539523

Potentially a consistent long term compounder

The simplest but most relevant analysis you will find on the Company. Read slowly, think carefully & you might agree !.... Do comment at the end for any clarification/ views.

Summary

Decent long term compounding story.

Sector Interest

😘 Flavor of the season.

Management

🙂 Good promoter driven Company with a solid professional board.

Financials

🙂 Decent business growth, stable margins, ok cash generation. Low debt.

Valuations

🙂 Closer to the lower end of historical valuation band.

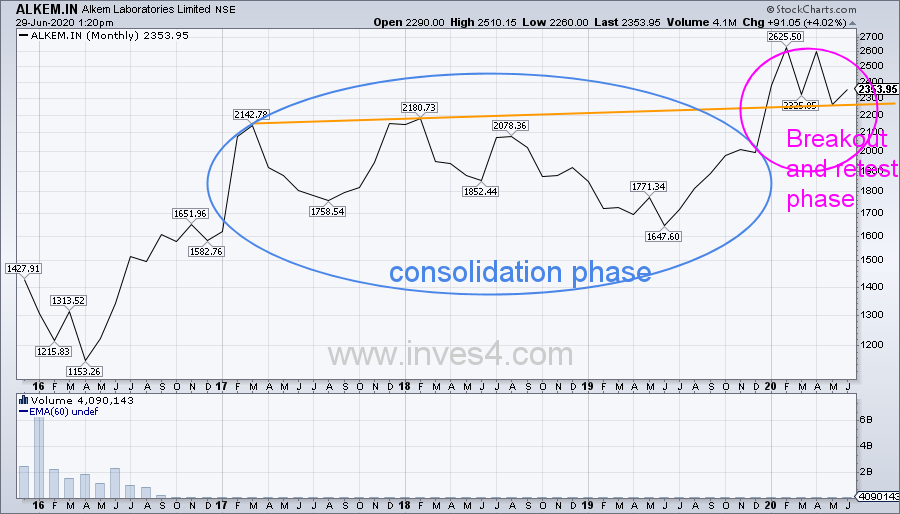

Technicals

🙂 Long term chart broken out in Jan 20 and retested the breakout in Mar and May 20

Investor Interest

🙂 Decent. Institutions have been accumulating from public.

SWOT

Strengths

- Amongst top ten pharma companies in India

- Leadership position in anti infectives segment

- Able management with strong professional board

- Low net debt levels

- Consistent business growth and stable margins

Weaknesses

- Significant (40%) business is from overseas

- Cash flow from operations are volatile vis-a-vis business growth and margins

- Valuations are not overly attractive

Threats

- Disruptions caused due to Covid2019. Surgeries are postponed impacting Company’s anti infectives

- Regulatory approvals

Opportunities

- Improving performance in the chronic therapy segments like Neuro / CNS, Derma and Anti-Diabetes

- Significantly growing Vitamins/ Minerals / Nutrients segment. This segment shall continue to find more and more acceptance in the post Covid2019 world

- As on March 31, 2020, the Company has filed a total of 144 ANDAs (including 2 NDA) with the US FDA and has received 89 approvals (including 13 tentative approvals and 2NDAs)

Management Quality

- Alkem is currently run by Sandeep Singh (MD). He is from the promoter family and is associated with the Company since 2003.

- Based on my reading so far, he seems reasonable and well regarded.

- The pedigree of people on the Board further testifies towards the corporate governance standards at the Company.

Click here for Alkem’s Board of Directors

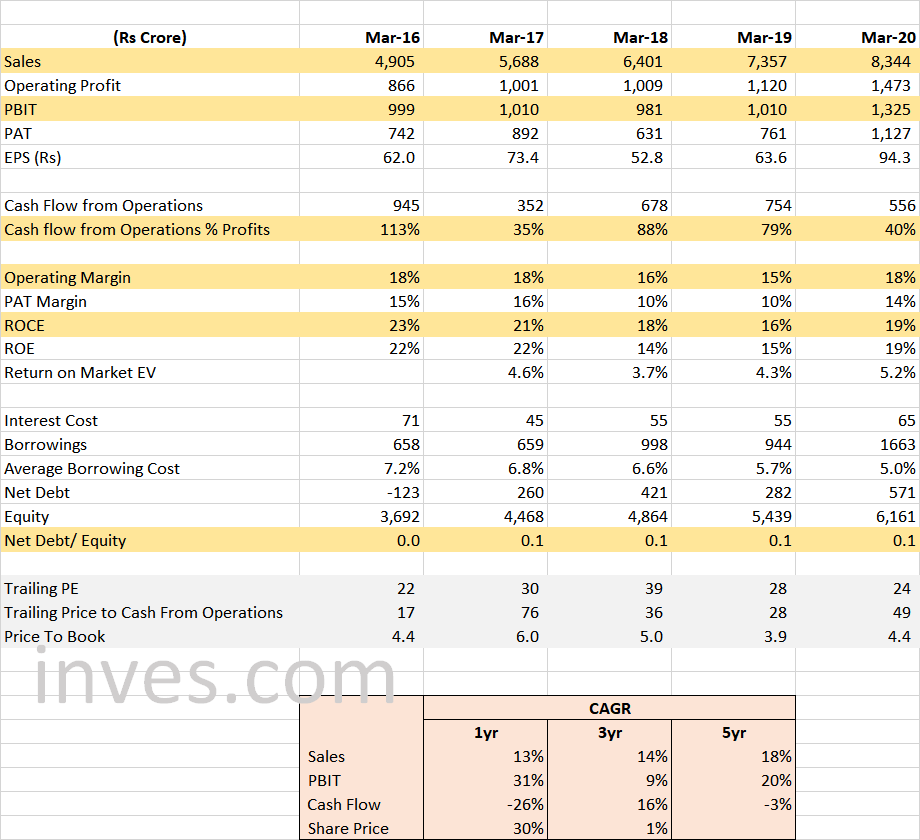

Financials

Auditors - B S R & Co. LLP

Bankers - Citi, HDFC, HSBC, Kotak Mahindra, SBI & others

Credit Rating -

Crisil (AA+ Stable, A1+), Fitch – IND A1+

- Company has a strong credit rating

- Revenues have grown consistently though with higher base the rate of growth is slowing down

- Margins are stable and return on capital is good

- Cash flow from operations have got hit in the current year but that maybe because of COVID2019 impact. I will be watching this very closely.

- Debt levels are comfortable

- Valuations are neither too low nor too high. From current levels, upside potential is more than significant downside risk. (Note: March 20 valuations are calculated at Rs 2,282/ share. Accordingly, please adjust the same as per current market price)

Important Links

INVES4 MODEL PORTFOLIO

An actively managed portfolio - cross between fundamental and technical analysis

Disclaimer: The information presented above is no advice/ recommendation. Please do your own independent research before taking any investment related decision.

Good and simple

Easy to understand .

Congrats to Inves4 for completing a year and wishing a long and successful journey ahead.

Really liked the lucid company review (Alkem) that you have posted.

The Summary, SWOT, analysis of Long term charts etc were quite useful in getting a comprehensive view of the Co.