Liquor Company

Radico Khaitan

Founded in 1943

Headquartered in New Delhi

Sectors - Liquor

Listed in -2003

NSE Ticker - RADICO

BSE Ticker - 532497

Keeps your spirit high !

The simplest but most relevant analysis you will find on the Company. Read slowly, think carefully & you might agree !.... Do comment at the end for any clarification/ views.

Summary

Slow and steady wins the race !

- Reasonably well governed and focused Indian liquor Company that surely should be looked into by anyone interested in this sector.

- The stock has generated a CAGR of 26% over the last 17 years. Very likely that the stock would continue to do well (>15%) for the long term investors.

Sector Interest

😐 Heavily regulated sector with political uncertainty. However, it has been always like that and good Companies find ways to mitigate those.

Management

🙂 Promoter family driven Company with reasonably long track record to rely upon.

Financials

🙂 Consistent improvement over the years. Reasonable growth, improving margins and reducing debt levels. Cash generation can be sometimes volatile.

Valuations

😐 Closer to historical average multiples. However, possibility of multiples expansion going forward.

Technicals

🙂 Trying to break out of a 2.5 year consolidation phase.

Investor Interest

🙂 Good. FIIs + DIIs together hold more than 30% of the Company and have been gradually accumulating from retail.

SWOT

Strengths

- Prudent, focused and disciplined management – company’s evolution over the years adequately demonstrates this.

- Well established brand portfolio – 8PM whiskey, Magic Moments Vodka, Contessa Rum, Old Admiral Brandy and others.

- Increasing focus on premiumisation of the brands – helping the Company both in terms of better image/ brand perception as well as higher financial margins. Premium brands in Q1 FY 21 contributed about 30% (Compared to 10% in FY 10) to Radico’s IMFL (India Made Foreign Liquor) volumes and 50% of the sales value.

- Pan India player – North contributes about 34- 35%, South 36-37%, East and West 15-16% and Canteen Stores Department (CSD) 10-11%.

- Extensive production and distribution network – 5 distilleries (3 own, 2 JV) and 33 bottling units spread across the country.

- Improving financial profile – decent growth, stable margins and returns, improving working capital management and reducing debt. Receivables from state governments need close monitoring – though management’s long track of dealing with that mitigates the underlying risk.

Weaknesses

- Highly regulated industry: Liquor industry is highly regulated in India with each state controlling the production, sales and duty structure independently. It is a major source of revenues for the State Governments and hence is a go to industry whenever State wants to raise it’s revenues. It has further become more susceptible after GST implementation – liquor being outside GST and hence being selective sector on which State Governments can exercise direct control

- Social and hence political implications – liquor is what liquor is. Sometimes this sector does takes political hits. We have seen it time and again in multiple Indian states.

- Cyclicality related to raw material prices: Basic raw materials required for liquor are agro based e.g.,. molasses, grains. These are prone to weather risks and seasonal volatility.

Threats

- Regulations and Politics – these are the biggest threats to the liquor sector and can create significant volatility for underlying Companies atleast over the short periods.

- Covid led disruptions – this is more relevant for the immediate future. Infact liquor has already largely bounced back and would soon reach pre Covid levels both because of strong consumer demand as well as support from the various State Governments (given the sector being a major source of revenues for them).

Opportunities

- Favorable demographics – given the economic optimism around India coupled with high proportion of young population.

- Gain market share – Radico’s current market share (IMFL) is around 7%. However, with focused product launches and targeted marketing efforts, Radico has been continuously gaining market share – e.g., in FY 19 it grew 18.5% against industry’s 9%, in FY20 12.5% compared with 0.5% and in Q1 FY 21 (-)43% compared with industry’s (-)50%. One can very well assume the same to continue given the underlying dynamics of greater brand acceptance, larger distribution, focused marketing efforts and new launches.

- High barriers to entry – liquor policies governing its production and sale are entirely controlled by respective state governments. Hence, it’s very difficult for a new player to enter and create pan India distribution network. At the same time, liquor taxes and fee are a major source of revenue for state governments prompting them to be open towards higher sales of liquor and hence natural advantage to incumbent players like Radico.

- Increasing brand equity in international markets – though Radico sells its products in over 85 countries, exports currently account for only 5-7% of the it’s revenues. The Company is gradually upping the ante and has received excellent feedback and recognition on it’s recent super premium launches including Rampur PX Sherry, Rampur Double Cask. This I believe shall greatly encourage the Company to continue its efforts in this direction.

Management Quality

- The Company is run by the promoter family – the father son duo – Dr Lalit Khaitan, CMD and Mr Abhishek Khaitan, MD

- Over years they have been successful in transforming Radico from a contract manufacturer to own brands manufacturer.

- They are ably supported by professionals, many of whom have been with the Company for long.

- The Company seems to mostly follow a well laid out long term strategic plan towards its operations as well as financials. One can call them to be calculative and not impulsive.

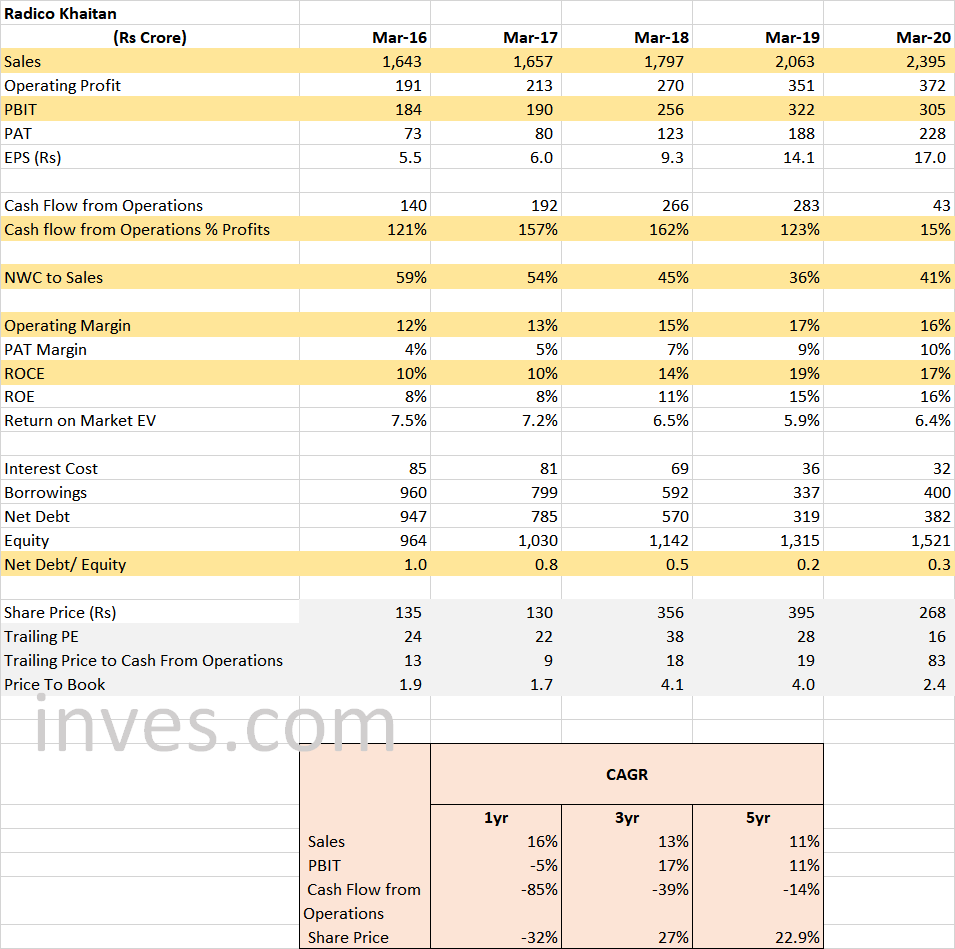

Financials

Auditors - BGJC & Associates LLP

Bankers - HDFC, SBI, Kotak, Axis, PNB

Credit Rating -

Care AA- (Stable), A1+

Improving financials.Working capital is a key monitorable.

- In line with the past, it would be reasonable to expect a minimum sales value growth of 10-15%. As detailed above, Radico should continue to gain market share in the foreseeable future.

- With focus on premiumisation, continued focus on controlling costs and benefits of operating leverage with scale, margins should be maintainable. Raw material price fluctuations can sometimes play spoilsport over short periods.

- Given Radico’s extensive production and bottling tie-ups not much is expected to be incurred on incremental capex (other than maintenance of Rs 50-60 cr per annum). Capital requirements should therefore remain low and hence returns on capital should continue improving.

- Company over last 6 years has been consistently reducing it’s debt levels. Net debt stood at Rs 260 crore at the end of June’ 20 compared with Rs 889 crore in March 2014. Company targets to become debt free in the next two years. Cash generated from operations should adequately help Company to achieve that.

- Marketing expenses are expected to continue ranging between 7-8% of the revenues and with higher topline will allow Company to further improve the quality of its efforts in this direction, which should further help Radico in creating a better brand image and a wider consumer base.

- Given the dynamics of the sector, working capital requirements can sometimes be tricky. However, Radico’s long proven track does mitigates the associated risk. E.g., Cash flows in March 20 quarter (Rs 200 crore) got stuck due to delay in payment by certain State Corporations. It subsequently got addressed but spoilt the balance sheet and liquidity position as on March 31, 2020.

- At the current share price of Rs 392 (as on 18th August’ 20) and normalized level of operations (excluding Covid impact), Radico is trading at about 24x trailing P/E multiple. This is in line with its historical average. However, with increasing market share, better brand acceptance and improving financial profile, I would not be surprised if one sees an expansion in the multiples. Radico does offers a relatively cleaner and focused play on the liquor sector vis-a-vis most of it’s other competitors.

Quite exhaustive