Indian elections 2019 are coming to the climax and we are only few days away first from the exit polls (starting this Sunday evening i.e., May 19th, 2019) and then the final results (on May 23, 2019).

Two questions that everyone has in mind currently- What would be the result ? and

- What would be its impact on the Indian stock markets?

There are varied opinions on both the questions and they are as confusing as they can get.

On question 1, I would dare not attempt to try answering it, not being my area of study. However, I would surely suggest that anyone interested should definitely read this piece – the most balanced and the best analysis and opinion on the subject that I have come across. Its from Ruchir Sharma of Morgan Stanley, someone whom all of us love and admire !

Question 2 – Impact on Indian stock markets – the question that this post is trying to address

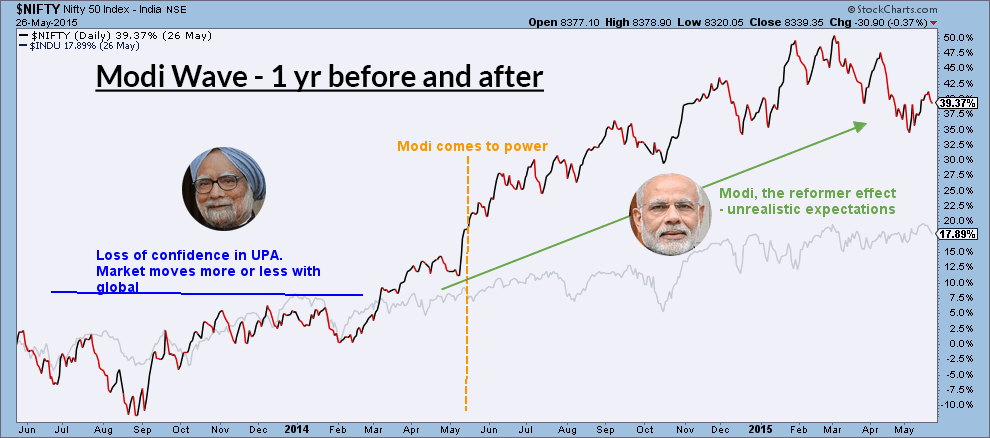

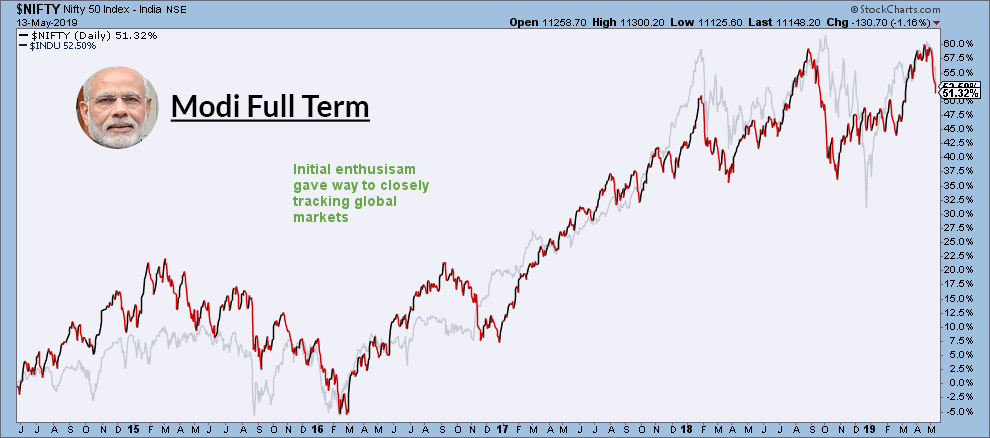

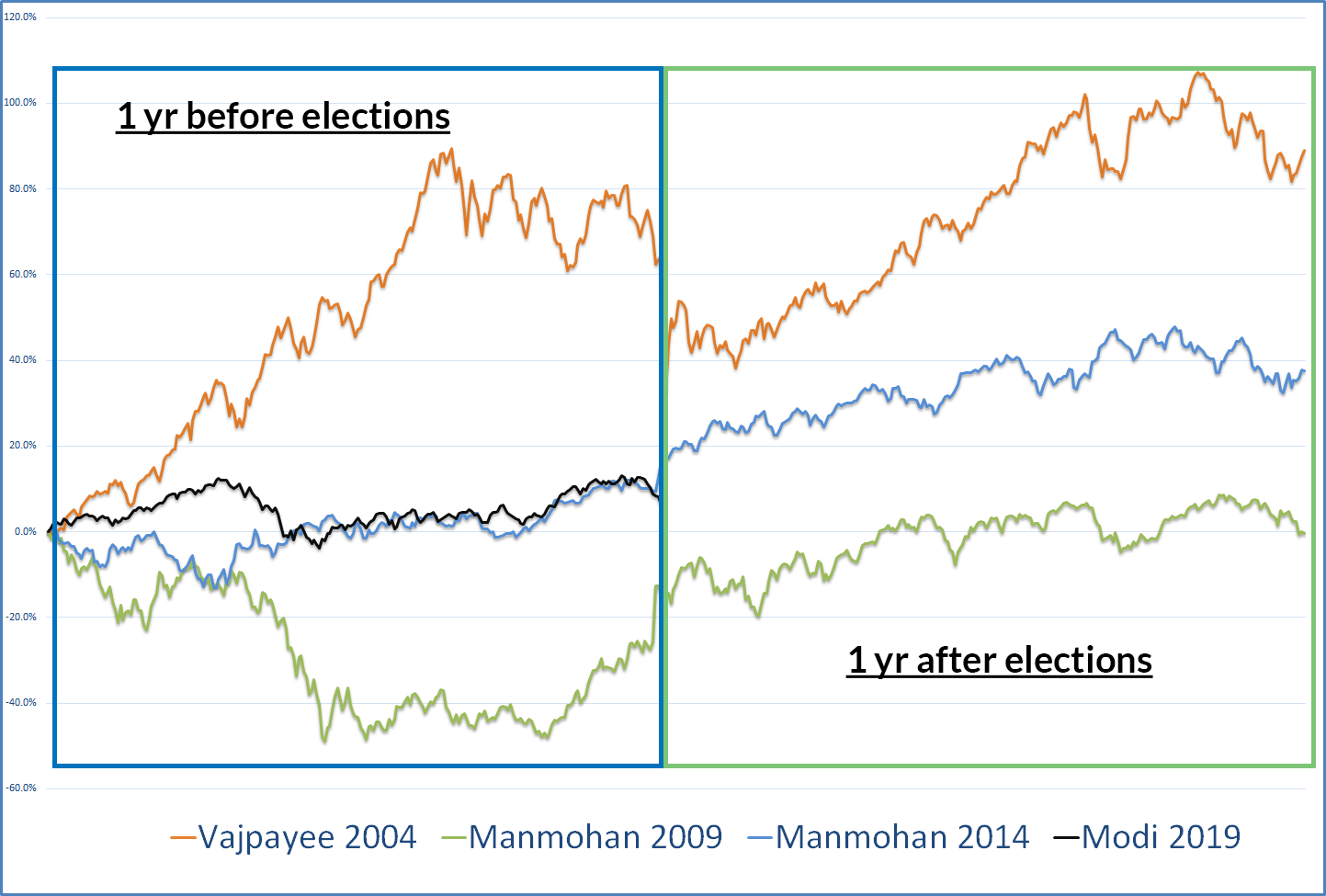

Here it is important to understand that what we are facing today is not something where parallels cannot be drawn from the past ! We have seen India shining phase of 2004 elections, UPA-1 reelection expectations in 2009 and Modi Wave of 2014 elections and we have seen how stocks markets have behaved before, during and after those periods.

So the effort here is to provide you details on the past history and see if we can draw some inferences from the same and based on our own risk appetite decide upon what to do in the stock market

Have a look at the following tabs for Indian stock market performance during various phases in the past –

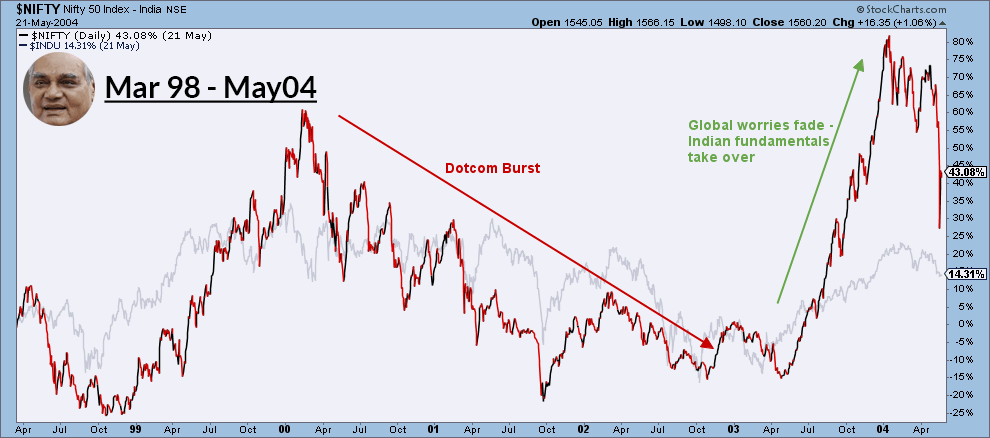

- During global selloff, Indian stock markets fell much steeper.

- Once globally the situation settled, our fundamentals took over, the govt’s policies were appreciated and we had a super bull run

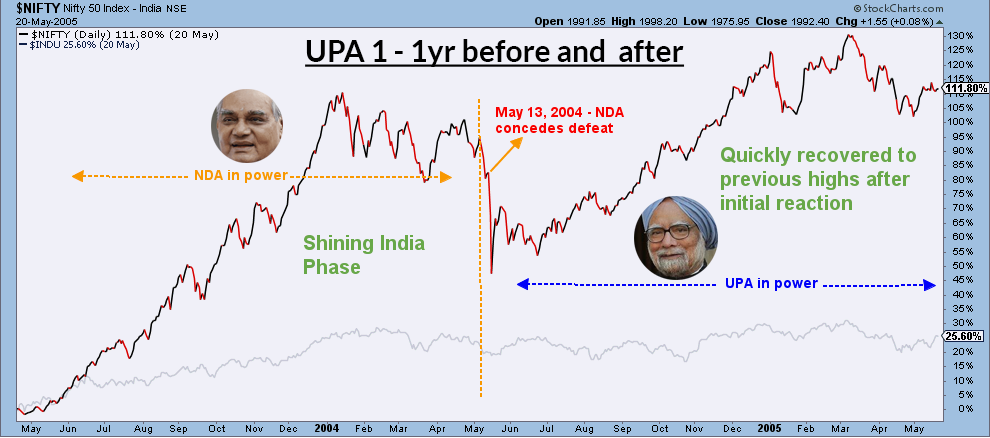

- There was a widespread expectation of Vajpayee coming back into power and when that didn’t happen, it was a quick sell off in the Indian markets

- After initial dip, the markets gained ground immediately and we had a secular bull run

- Please do note that UPA-1 was a khichdi government with the largest party i.e., Congress only having 145 seats out of a total 272 required for the majority to form the government

- Many a times it is said that UPA-1 was a success because of work done by the Vajpayee government. However, that is not the issue, the issue here is how stock markets reacted when the popular leader didn’t return to power and the government that is formed doesn’t have a clear majority and hence the contended issues of stability and flexibility to reform.

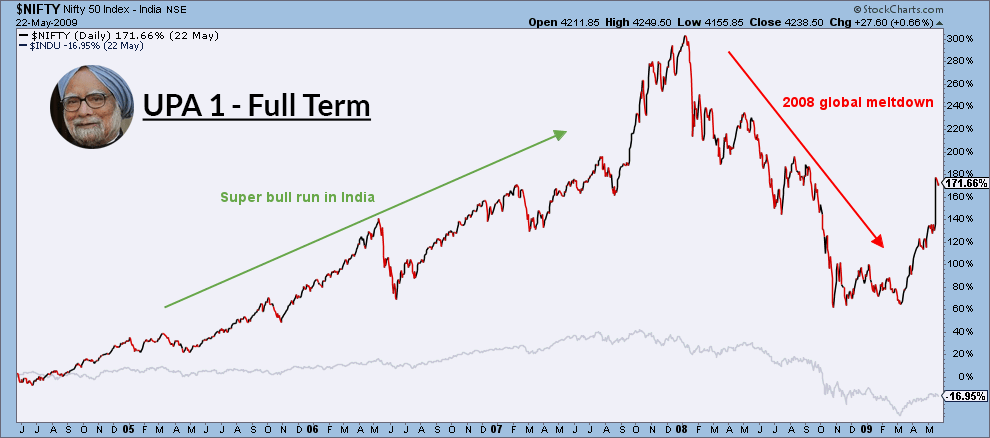

- India underperforms again during global market selloff in 2008

- As global markets get settled, Indian fundamentals return again, confidence on Manmohan government continues for the initial period and we continue the outperformance

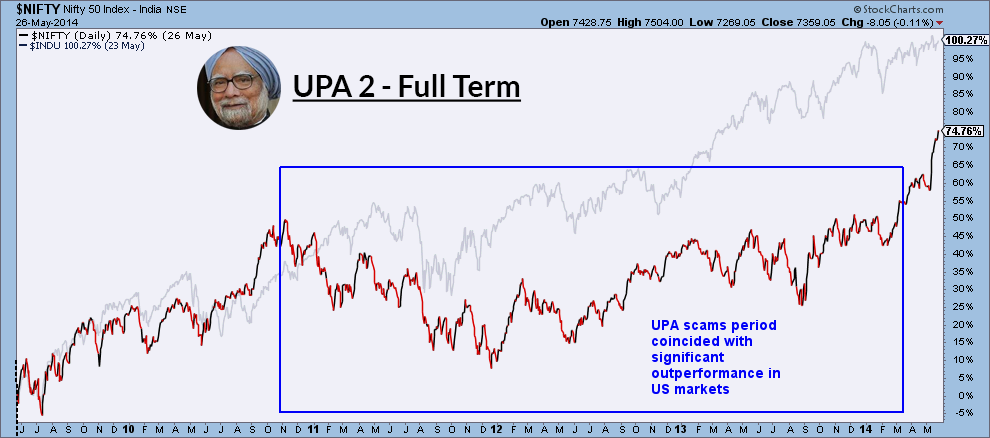

- Thereafter UPA scam period coincides with the super bull run in the developed markets and the Indian markets though continue increasing start underperforming

- Initial unrealistic expectations gave way to being more watchful and follow the global cues

Implications of the above past analysis on 2019 election results

First lets summarise the key inferences from the above past analysis –

- One of the most critical component of how Indian stock markets perform is how the global environment is. How much so ever we want to believe otherwise, we are unlikely to perform in the opposite direction to global markets over an elongated period. Traditionally we have been a high beta market especially on the downside – if global markets fall, we fall faster and that is due to various factors including we being an emerging economy, lower depth and so on and so forth.

- Fundamentals of our economy (i.e., growth and in turn corporate earnings) take over if global markets remain stable, there is no structural sell off or are increasing. In these scenarios, we are likely to perform better.

- Politics or leaders and hence election results do make a short term immediate impact (in line with greed and fear psychosis), however are unlikely to create any structural shift as nothing is permanent.

2019 election results impact on Indian stock market

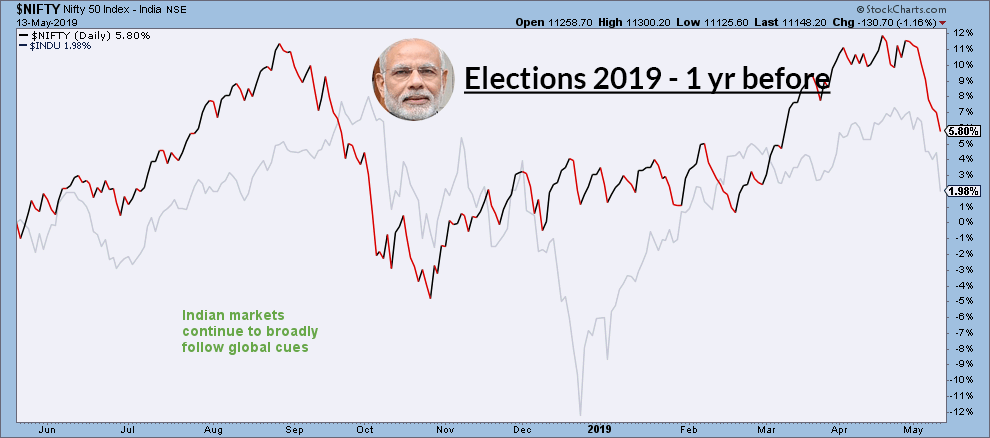

What Indian stock market has done in the last 1 year and is there any parallel of that in the past? Lets have a look at the following chart –

Strikingly and very unexpectedly the stock market performance in last 1 year has been similar to that of 2014

Strikingly and very unexpectedly the stock market performance in last 1 year has been similar to that of 2014

What about vis-à-vis global markets?

More or less is tracking the global stock price movements, keeping the high beta factor alive…..

More or less is tracking the global stock price movements, keeping the high beta factor alive…..

All this is assuming supportive global markets as discussed above.

Scenario 1: NDA returns with clear majority

Market will love it on immediate basis and you will get a significant uptick. However, I would predict a decent correction after that and maybe market giving up all the gains gradually when institutional investors might be prompted to book profits.

Modi is now a known person and investors know his leadership style. They like him but would wait to see further policy decisions and its impact on corporate earnings. The fact remains that currently the macro environment and corporate earnings are not supportive.

I would be a seller on the uptick in scenario 1

Scenario 2 – NDA returns but with lot of jugaad

Market might not like it on an immediate basis but would be happy that Modi is coming back. There might be a small correction on immediate basis, which would be bought soon and infact in this scenario I expect India to see a significant follow through.

Many investors might like that policies of the government would now be kept under check and their wont be any disruptive announcements.

I will be continuing to buy on every dip in this scenario. My most favored is this scenario 2

Scenario 3 – UPA comes to power with Congress the largest party and with support of many smaller parties

Significant immediate downtick might happen with an immediate recovery to in and around current levels. Congress again is known to investors and hence they would not be overly worried. Besides, current valuations are not that expensive especially in the small and mid cap. People will also draw comfort from the fact that policies of Modi government will start yielding results.

I will be a significant buyer on downtick in scenario 3

Scenario 4 – Third front comes into power

The most unsettling scenario from an investor’s perspective as we would be bound to go for re-elections sooner or later. Significant fear would take over, even if not on the downside atleast stopping it to move on the higher side.

In scenario 4, I would be forced to become inactive for some time or completely move towards the defensive blue chip stocks.

That brings me to the end of my post. I hope you enjoyed reading it as much as I researching and writing it and helps you in strategizing your participation in the Indian stock markets.

Please feel free to connect on nitin@candidcap.com for any issues or suggestions.