Recently many brokerage reports and business news channels have been recommending a strong buy on Indian midcaps. The underlying provided justifications are:

- No political uncertainty – with NDA coming back to power and that too with a very strong mandate.

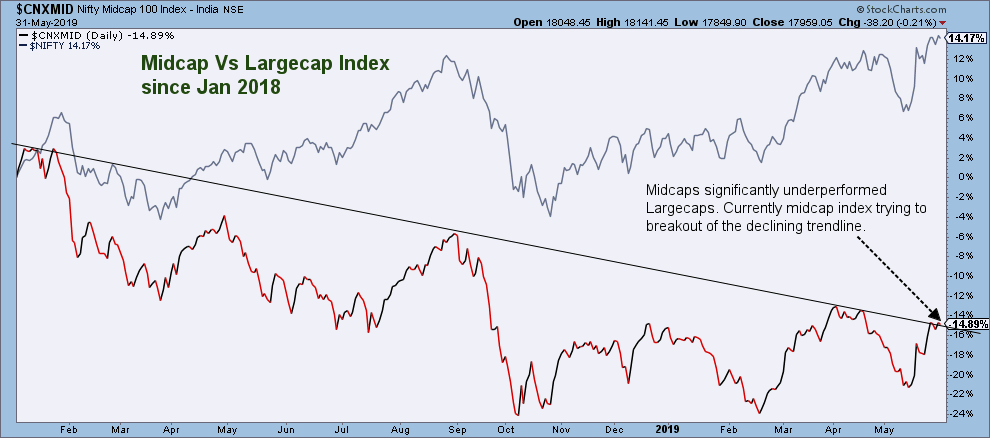

- Midcaps underperformance vis-à-vis large caps – since January 2018 and hence with risk appetite coming back, funds would switch back to midcaps.

- Attractive valuations – Forward PE (Price to earnings ratio) for midcap index at 14.8x is at discount of almost 20% to nifty 50 index – whereas as per long term averages the discount should be no more than 10% (for reference at the peak in January 2018, forward PE of midcap was infact at 40% premium to nifty50).

We don’t dispute any of the above points. However, it might not be as simple !

Selective fundamentally strong companies will always do well irrespective of what is happening at the index level…

Question is whether midcap index in general will have a secular uptrend pushing majority of the midcap companies at historic highs?

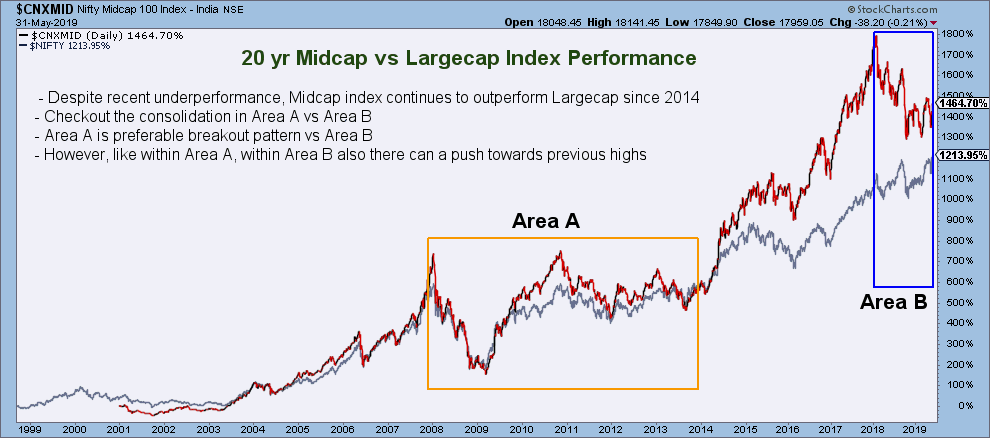

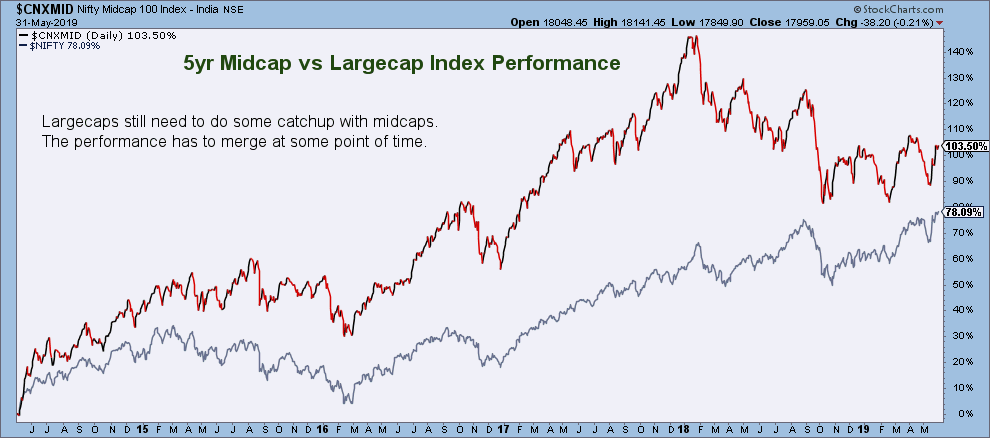

Have a look at the following midcap vs largecap index charts over varying periods

What we can see from the above charts?

The kind of divergence everyone is speaking between midcap and largecap index is only valid for extremely short term. Over medium to long term its other way around.

Technically , Midcap index needs to consolidate much farther and longer before breaking out again.

And what about the sentiments? Are they supportive?

Midcaps by nature are high beta and hence need strong favorable sentiments (sort of euphoria) both domestic and foreign for strong upmoves. The fact remains that the only positive thing that has happened currently is political euphoria. Rest everything is concerning and needs more time to play out.

Domestic macro numbers are still struggling – corporate earnings are at best modest, auto and consumption continue to be weak, GDP numbers are low, unemployment is high, NBFCs are struggling, liquidity is tight, banks are still not out of the woods.

RBI’s soon to be announced credit policy on Jun 6, 2019, policy initiatives by new NDA government, Union Budget on July 5, 2019, Q1 results starting mid July 2019 and monsoon would be the key events watched by market participants closely.

US-China Trade war continues unabated – no one seems to be backing off for now. Infact US also seems to be increasingly focusing on negotiating with India. Here its also important to note that US markets have had a super bull run since 2009 and is long overdue for a significant correction.

Ideal scenario for us – improved domestic fundamentals along with gradual selloff (or consolidation) in US markets leading to shifting of money from there to here as opposed to panic sell off in US markets leading to shifting of global liquidity towards safe assets. ConclusionAny significant selloff in US markets is bound to impact Indian markets negatively irrespective of any other positives.

There are multiple factors to be considered before becoming euphoric about midcap stocks in general. We don’t think there will be easy money for investors anytime soon and hence recommend to be extremely choosy and quality focused and still be ready for some turbulence !

Nicely presented the complete scenario considering all relevant factors and the near term possibilities.

Its informative and useful. Thanks