I have been investing into equities since 2002 and over the years have had my share of successes and failures.

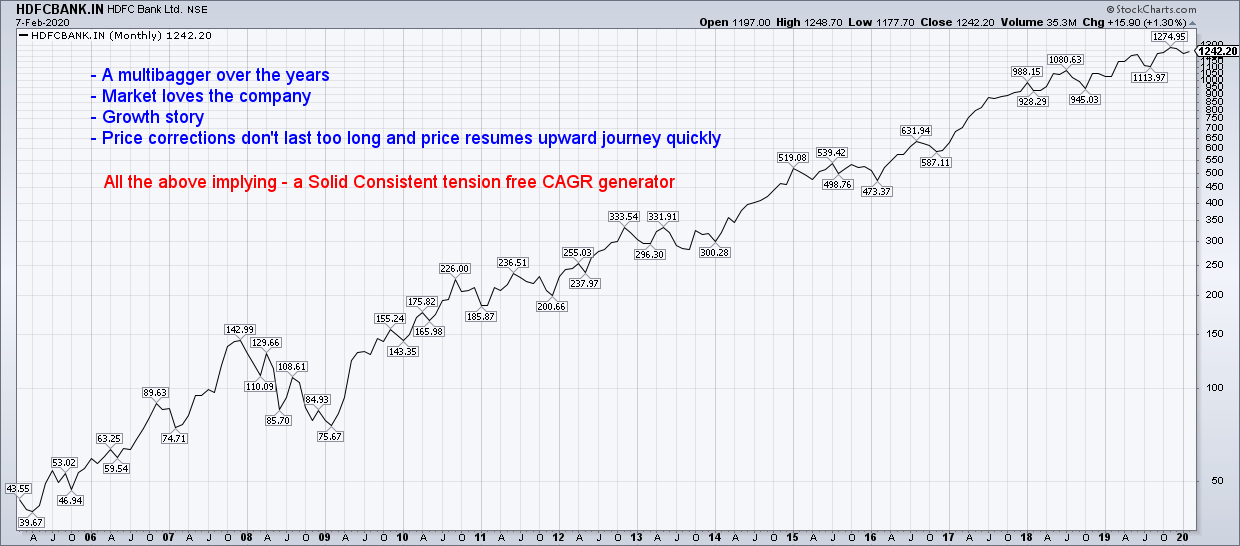

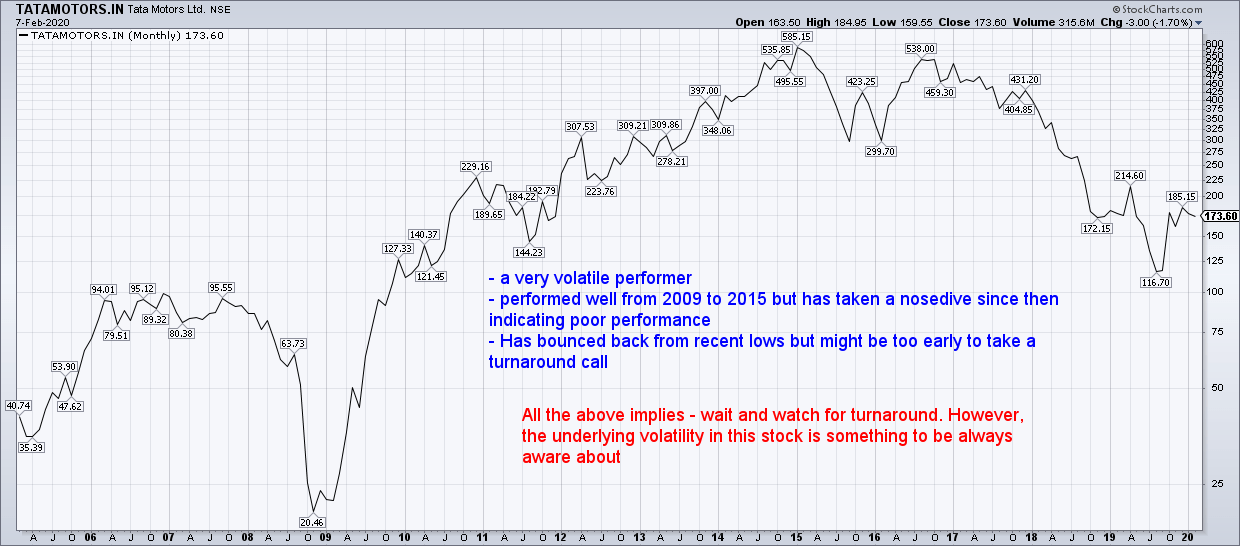

I may have identified multibaggers like Bajaj Finance, Asian Paints, HDFC Bank, Maruti, Nestle, Venkys etc. But then I have also invested in duds like Tata Motors, REC, Geodesic, Redington, D-Link etc.

When I looked back and analyzed those experiences, my most significant observation was –

I faltered mostly when I only relied on my opinion ignoring what the general market believed.

Being a fundamental investor, I was always looking for undervalued companies and trying to prove my supremacy and intelligence over the general consensus. In the process, I was doing financial analysis, reading research reports, listening to management and relying on grapevine information.

As such there was nothing majorly wrong with the approach and I did stumble upon some great investments. However, it did lead me into many poor over confident investments as well.

There is a difference between value buy and value trap.

The fact remains that pure value buying requires presumptions and assumptions about lot many variables – something on which no one has any control and hence despite the best efforts can go wrong. Also, pure value buying has a tendency of coloring one’s opinion – after the initial analysis, if there is a broad liking for a Company, one starts looking for positively biased information about that Company.

I am in no way intending to undermine the importance of value buying here. Fundamental analysis continues to be a core part of my investing strategy. However, over years I have realized that there is no point in ignoring the collective intelligence of the market and trying to prove my supremacy.

I now try to gauge market’s perception about the Company first and then follow that up with fundamental analysis.

How do I do that?

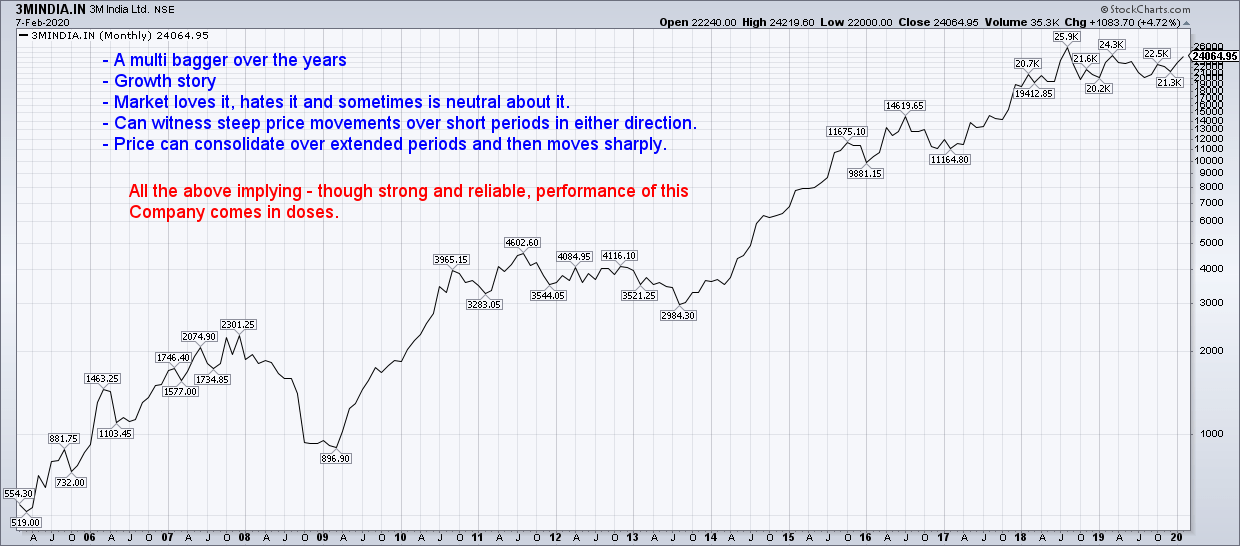

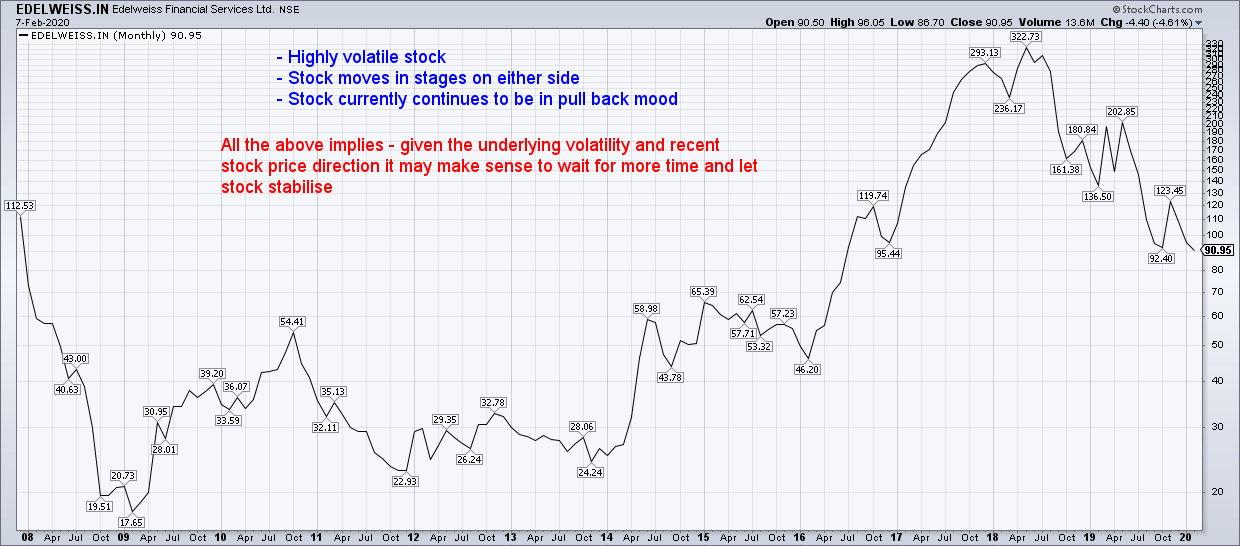

Zoom out and look at long term price chart of the CompanyLots can be implied from the long term price chart of a Company –

- How consistently it has performed vis-a-vis market’s expectations

- How volatile is it vis-a-vis market and economic cycles

- What has been it’s typical price movement patterns – some move in stages and some only one way

- Whether it’s a growth story or a turnaround story

Answers to these questions help me in getting a feel whether market loves a company, hates it or is neutral about it. This in turn helps me in deciding whether to go into further details or not.

Some real life examples –

Look closely again at the above charts, give them a careful thought and I am sure you will find this to be a very powerful tool to identify a Company that suits your own risk aptitude.

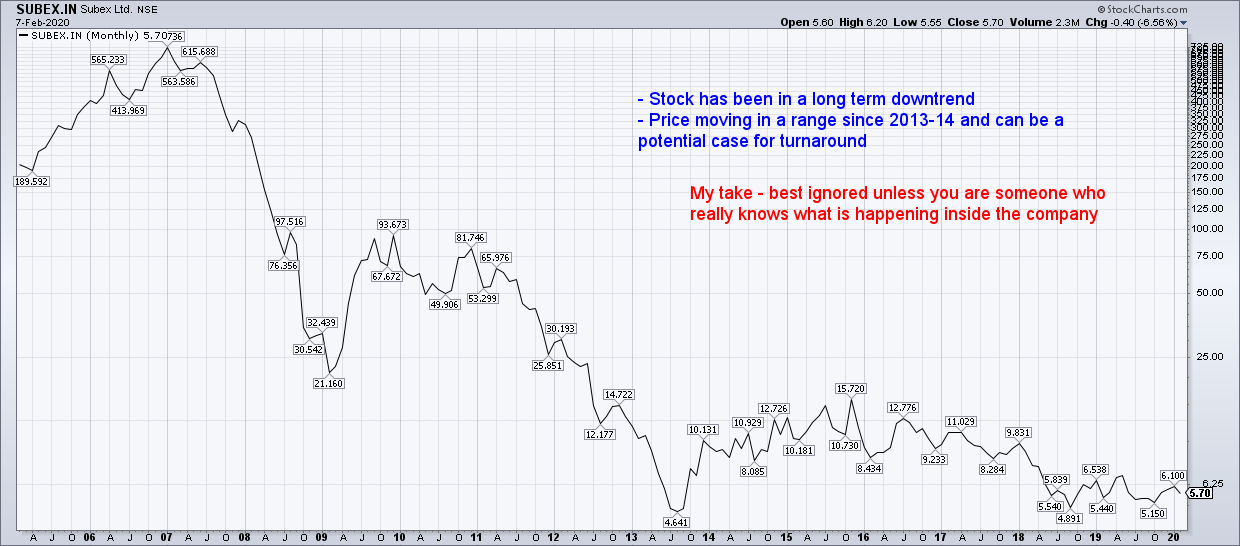

E.g., when I evaluate Tata Motors now, I know the backdrop in which I have to evaluate the Company. More than just financial numbers, I have to look for cues indicating the turnaround or at least stabilization of operations. Likewise, I now know Subex is not for me currently – so better invest bandwidth analyzing some other Company.

There is no right or wrong investing strategy. What one likes is a function of his own skill sets, risk aptitude, return expectations and investment horizon. A long term chart provides a quick first stage screening tool.

To conclude – I have found long term charts to be a very simple and effective strategy to identify and analyze stocks. It helps me in understanding the underlying character of the Company and then decide whether that suits my own character !

Disclaimer: Above are my personal opinions and not any recommendation. The reader should do his own research before taking any investment related decision.

Illustration Credit – Vecteezy.com

Very very simple way to take the first step …I remember when u first tweeted about this sometime back…it is helping me a lot

A strong message conveyed in a very simple style…… reemphasizing the value of long term charts. A techno funda approach towards shortlisting potential winners helps. Also this does help cut the noise from short timeframe charts.

Nitin sir I am a beginner investor…I see investing as my career. I need to learn a lot, Do you have any suggestion for beginners to gain knowledge clearly.

Very useful observation and a check that must be done before making a long term investment. Thanks for sharing