Conglomerate into Cigarettes, Food, Apparel, Personal Care, Hotels, Paper, Agri & IT

The simplest but most relevant analysis you will find on the Company. Read slowly, think carefully & you might agree !.... Do comment at the end for any clarification/ views.

Summary

APNA TIME AAYEGA !

- Everything is good about ITC – the managament, the brand, the distribution network, the finances. However, still the stock has been under performing for long.

- Key reasons as per me – too many focus areas and regulatory risk associated with its cash cow business, i.e., Cigarettes.

- Company is generally considered conservative while taking decisions on it’s surplus available cash/ liquidity.

- Management has always been aware about the above but has resisted to make significant structural changes due to varied reasons. However, they are bound to lose patience and now it seems sooner than later.

- In worse case, I expect ITC to return 12-15% CAGR (including dividend) to long term shareholders. In best case and with some structural changes, it can be significantly more !

Sector Interest

😐 Positives, negatives cancel each other out

Management

🙂 One of the top Indian Company wrt corporate governance

Financials

🙂 Good business growth, solid margins, strong cash flows, no debt and cash rich

Valuations

😇 Very attractive on consolidated basis. Closer to 50% of historical valuation levels. However, don’t over simplify and assign FMCG valuations to the entire business !

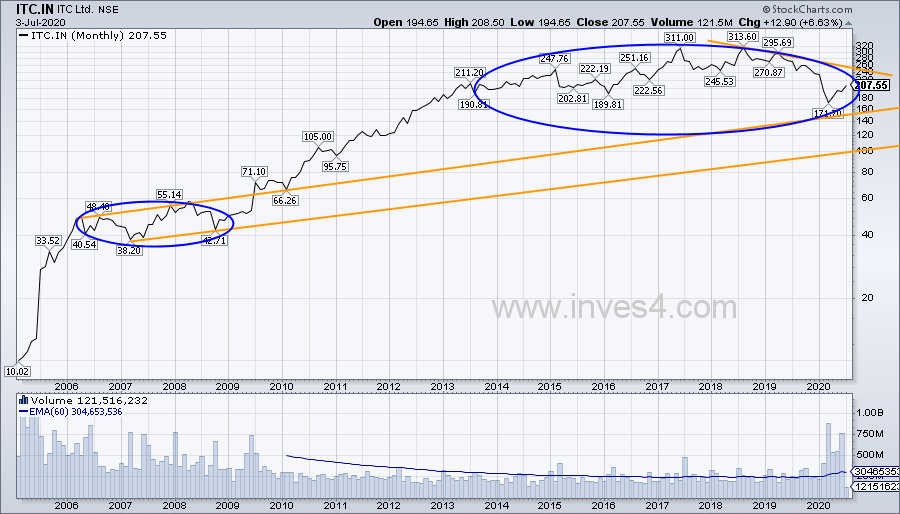

Technicals

😐 Long term chart currently in consolidation phase. Movement expected between Rs 160 to 240 levels in near term.

Investor Interest

🙂 Always good. ITC draws significant attention from every type of investor/ trader.

SWOT

Strengths

- Clean, respected Professional Management

- Market leadership in Cigarettes with brands like Classic, Gold Flake

- Growing FMCG and consumer business with well known brands like Aashirvaad, Bingo, Sunfeast, Fiama, Savlon, Engage and others

- Established track and branding in hotels business with a network of more than 100 properties across locations

- Good overall financial numbers – decent growth, stable overall margins, strong cash flows, zero net debt

- Significant available liquidity to grow organically or inorganically- cash equivalents of Rs 32,000 cr as on March 31, 2020 equivalent to 12.5% of the current mkt cap (July 2020)

Weaknesses

- Cigarettes being a sin product and also luxury (vs other tobacco products) is always a go to product for government to increase taxes

- Too many focus areas within a single franchise – with the result that investors many a times get jittery about non performing businesses or over play the risk of taxation on Cigarettes during weak overall economy.

- 84% of ITC’s operating profits in FY20 was contributed by Cigarettes. Yes other businesses are growing but 84% is a significant number and given this the consolidated business can not command a FMCG valuation.

- The Company has always generated strong operating cash. Hence it has always been blessed with abundant liquidity. However, one can potentially argue that it has never utilized that to create significant shareholder value especially via inorganic route. The Company’s liquidity is primarily invested into market investments that cannot be considered prudent. Recently, Company seems to have opened up more towards distribution of dividends to the shareholders.

Threats

- Cigarettes tax regime will likely continue to be highly unpredictable

- COVID2019 impact on demand for Cigarettes due to health reasons. Short term, I believe there would be a sizeable impact. 9-12 months post virus cure, it should be back to normal.

- Significant established and increasing competition in FMCG and consumer business from old and new Companies including Britannia, HLL, Pepsico, Parle, Vini, Veeba Sauces and many others. Besides with the evolution of eCommerce platforms there have been many new brands that have started mushrooming over last few years and finding it easier to catch customer attention

- Covid2019 impact on its hotels business – though for me it would be more of sentiment issue than any sizeable impact. In FY 20, hotels contributed just 3.4% to ITC’s revenues and less than 1% to it’s overall operating profits.

Opportunities

- Significant potential to grow Cigarettes – legal cigarettes comprise less than 10% of tobacco consumption in India

- Leverage existing distribution infrastructure and reasonably strong recall of it’s established brands to roll out newer products and target a higher customer wallet share

- Potentially try unlocking value for shareholders via de-merging different businesses

Management Quality

British American Tobacco controls about 30% of ITC. Balance is widely owned by institutions and the public.

- The Company has always been run by professional management

- It has been one of the cleanest run franchise in India

- Investors need not worry about corporate governance standards at ITC while taking their investing decision

Click here for ITC’s Board of Directors

Financials

Auditors - S R B C & Co. LLP

Bankers - NA

Credit Rating -

Crisil (AAA Stable, A1+), ICRA (A1+)

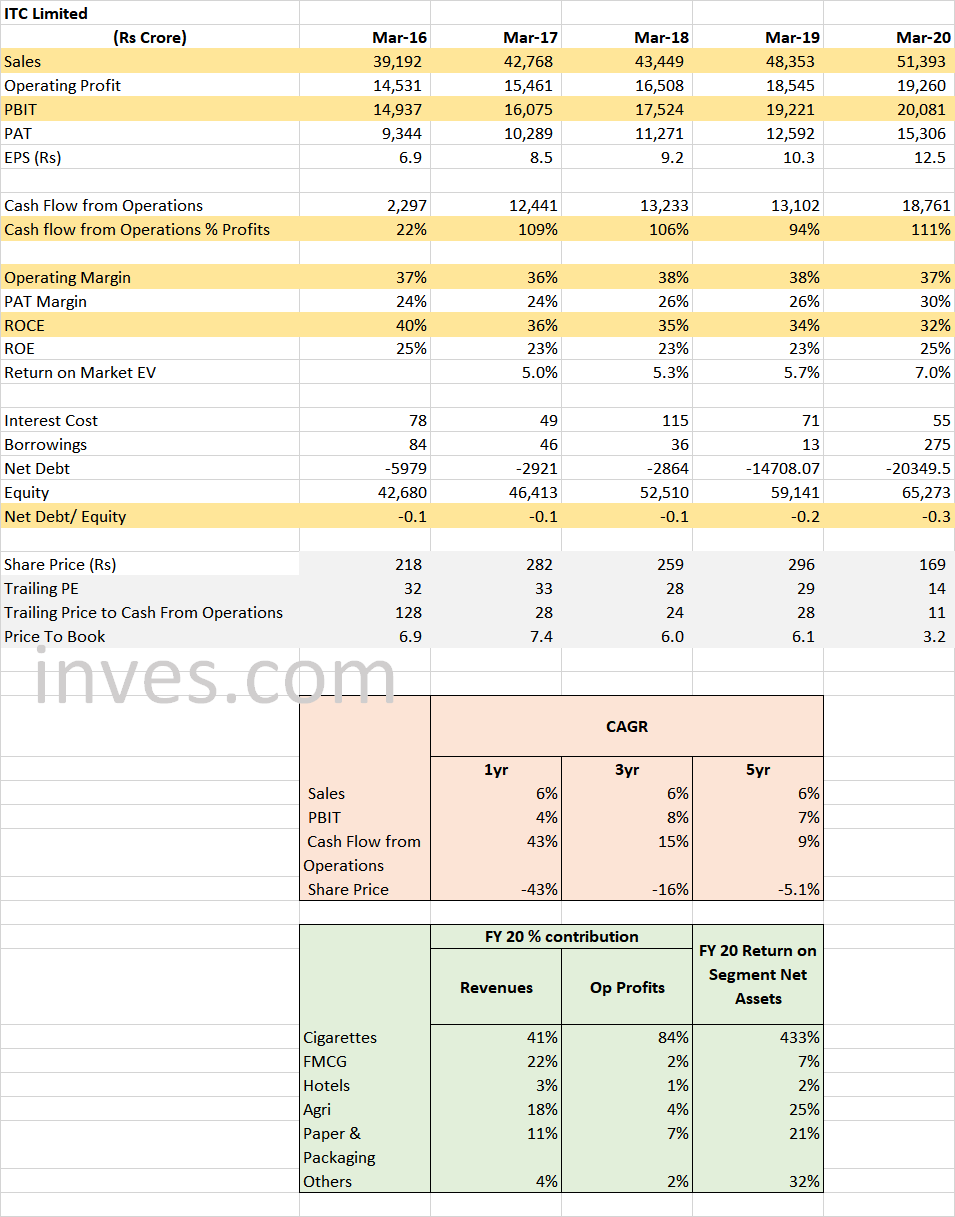

There is a reason why most investors still consider ITC to be majorly a Cigarettes Company !

- Cigarettes generate humongous profits and cash flows for the Company

- In terms of revenues, Cigarettes contribution has been gradually declining and in FY 20 it contributed 41% of total revenues. However, in terms of profits it contributed 84% ! (Check financial tables below)

- FMCG on the other hand contributed 22% to revenues but just 2% to profits.

- Hotels is insignificant whereas Agri and Paper are respectable contributors.

- Overall margins, returns on capital, cash flows, liquidity continue to be very comfortable.

- Current valuations definitely seem to be on the lower side. (Note: March 20 trailing valuations are calculated at Rs 169/ share. Accordingly, please adjust the same as per the current market price)

It has been observed that ITC has the pricing power since whenever govt increases the taxes they also increase the price of cigarettes and the demand doesn’t get significantly impacted but despite that it has never become the darling of the market

Whats your thoughts around free float of ITC and constantly increasing equity YoY? Is the playing a spoilsport when it comes to the share price?

ITC is a great co. in India suffering from too high float & bloated capital. The Co.Must stop issuing bonus shares & start periodic buybacks to reduce the float & use its FCF. BAT is a hurdle in buyback as its direct stake if increased may invite open offer. But ITC can pass any special resolution ignoring BAT as BAT is less than 26% & ITC enjoys full confidence of institutions. Of course this is my personal view only & not a great piece of knowledge.

The unlocking of value will.happen only when the different businesses are housed in different companies..

Demerger can unlock value.

Buyback will also work.

And just wait for its other than cigarettes FMCG to stabilise..they are still in launch mode for so many products and brands