Average Down (AD) – when one buys more number of shares as the price moves down.

Average Up (AU) – when one buys more number of shares as the price moves up.

Two exactly opposite approaches to stock market investing, wherein the final objective remains same – to make money by buying low and selling high !

Prima facie, this doesn’t make sense… right? How can two exactly opposite strategies achieve the same objective. It’s easy to explain this with the following real life example.

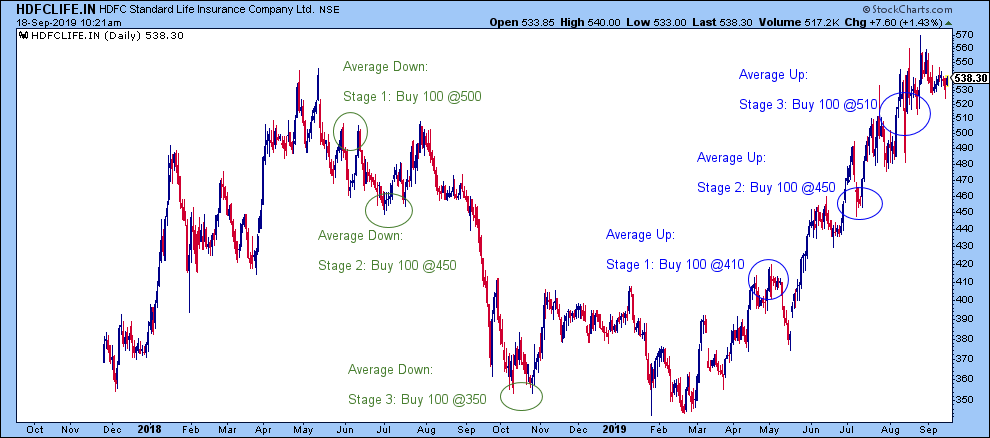

- Average buying price under AD strategy comes to Rs 433/ share and under AU strategy Rs 457/ share.

- Assuming both type of investors are currently holding shares, both are making money.

So yes, it is possible to make money under either of the strategy provided we know what we are doing.

Which is a better strategy?Average Down StrategyIt’s important to understand what each strategy entails and then relate that with your own skills and aptitude.

This strategy is favorite among fundamental investors – they mainly focus on value investing. In Value investing, one tries to calculate the fair price (FP) of a share and buys it if prevailing market price (MP) is significantly lower than FP.

Naturally, when they find value in a share at Rs 100, it becomes more attractive at Rs 80 and then further enticing down at Rs 60. They keep accumulating more as the price reduces bringing down their average buying costs.

Follower of AD strategy believes –

- Markets can be inefficient, can underprice stocks and therefore can offer attractive buying opportunities.

- Value buying is the best investment strategy and it requires patience.

The follower of this strategy believes that the only way one can be confident of his investment into a particular stock is when the price moves in his favor. Therefore, if the price drops, he never buys more. On the contrary he would exit if the price hits stop loss. He may enter later in the same stock again, if his analysis suggests so.

Follower of AU strategy believes –

- Markets are supreme

- His analysis can be wrong

- Prevailing conditions may not be supportive

Though followed by both fundamental and technical investors/ traders, AU strategy is more associated with the latter. Reason – AU strategy leads to frequent entries and exits – a trait generally associated with technical investing/ trading.

Personally, I don’t agree with the above argument. I believe this strategy makes as much sense for fundamental investors as it does for technical. I will try to address this point later in the post.

Both strategies sound logical, have proven success stories and equally pronounced failures.

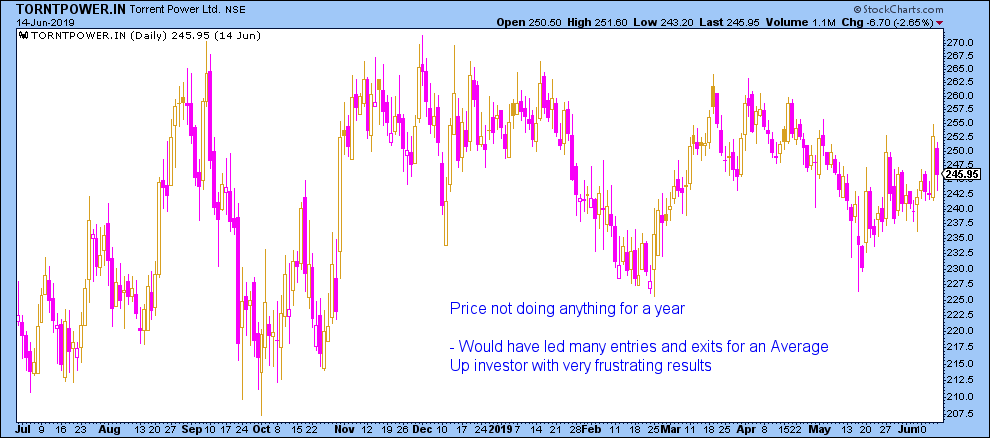

We saw HDFC Life chart in the beginning wherein both strategies made money. Now let’s look at actual Yes Bank and Torrent Power Charts.

In the above two charts, different strategies would have lost money in different companies.

What determines success in Average Down strategyNothing is right and nothing is wrong. What matters is how true are we to ourselves !

Are we ready to challenge ourselves?

This is most important to succeed in AD strategy. As mentioned before, AD strategy is a sort of extension of value buying, which in turn we associate with the legendary investor, Warren Buffett – though I believe, most of us have learnt it only superficially.

Yes, we calculate the FP of a stock and buy if MP is significantly lower than the FP. Thereafter, if prices declines we continue to buy more.

We continue to believe that our calculated FP was correct at the time of calculation and it continues to be so as the price is declining.

FP calculation is more of an art than science. There are too many variables involved. Even Company managements cannot provide accurate guidance on most variables.

Biggest problem is our inability to accept our mistakes. How can we be wrong – especially after putting in so much of efforts !

More than value buying strategy it becomes… aur kitna girega !

Yes bank is a classic example of the above – stock after declining from Rs 400 has been getting recommendation as value buy from 270 levels, followed by 240… 200…150…100… 80. Now most have given up.

Think again…. does Warren Buffett mean this, when he advocates value buying?

To be a sincere value buyer, one needs to put in significant amount of efforts – understand business, read financial reports, meet/ listen managements, take market feedback etc…. and still be ready to be proven wrong and continuously recheck his assumptions.

Yes, agreed, when executed properly, nothing can beat value buying… and in turn AD… it can generate huge wealth.

What determines success in Average Up strategyBe true to yourself – don’t try to satisfy your ego and indulge into AD and defend it by calling value buying.

Ability to not do anything or sit out of the market

I am serious… this is the most important attribute to be successful in this strategy.

Given the normal fluctuations in the market, the strategy can be frustrating at times and can stop out investors multiple times. This can be demotivating and creates doubts on the strategy. E.g., Torrent Power Chart above.

Following a disciplined tighter entry strategy can improve upon this.

One doesn’t need to chase anything and everything and can have clear rules to follow. E.g., in the same Torrent Power Chart above, a successful Technical trader would not have made any entry at all as there was no breakout.

AU strategy sometimes can also make an investor miss a significant secular move e.g., a stock suddenly increases by 20% in a day. Emotionally it becomes difficult to buy a stock at Rs 120 when you had bought it at Rs 100 and one waits it to come back to Rs100 – either it never comes back and if it does, you may not invest as you may now feel that it might go further down.

Though characteristically difficult, one can over time learn to buy stocks at continuously higher prices.

Till then, maybe, it would not harm to think – there are many companies to invest…. ek gaya doosra milega !

Fact remains, AU is a solid risk controlled strategy. It can be a saviour during bear markets.

You can follow this strategy even if you are a fundamental investor. Yes, fundamentally you see a value in some stock and make the initial investment at Rs 100. Under AU, you make a follow on investment only when the price moves above Rs100. Isn’t this the best way to confirm your own calculations? If the price moves above Rs 100, you were right and can buy more. If it moves below Rs 100, maybe your value calculation was incorrect. Think about it…

I hope to have given you sufficient points to think. What you choose to follow is entirely a function of your own likes, dislikes, skillsets and aptitude.

Both strategies will give you sufficient opportunities to make mistakes, learn and win.

Personally, I continue to improvise upon my own investing strategy. One thing that I have religiously tried to stop in the last couple of years – Average Down – saved me few times. Not to say that I don’t focus on Value Buying. I do…. but I am ready to recheck myself and accept that I might not be knowing as much as market does !