In line with the recent speculations, Board of Adani Enterprises (AE) has approved raising of further equity from public (FPO) aggregating up to Rs 20,000 crore.

Proposal is subject to the existing shareholders’ approval which should not be a challenge given it’s shareholding structure – at September 2022 end, promoters held 72.62%, FIIs 19.12%, DIIs 5.33% and balance 2.93% by public.

Besides, given AE’s current valuations of trailing PE of 360x, I see no reason why existing shareholders would have any reason to deny the subject new equity raise – significant money will come into the Company at very low dilution (current mcap of Rs 4.44 lakh crore implies a dilution of <5%).

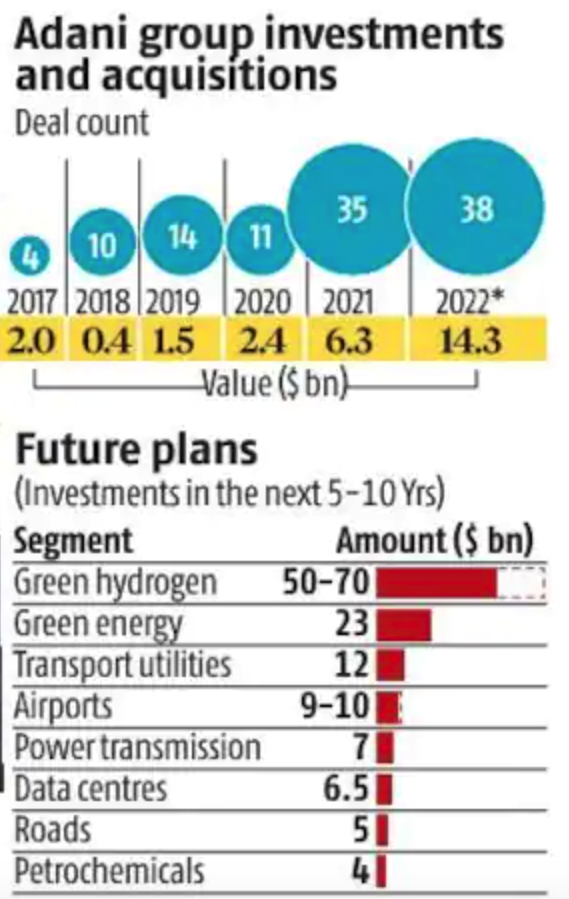

Usage of funds – Company intends to use funds for funding it’s growth plans. Checkout the following picture (sourced from Business Standard)

AE has laid out $150 bn expansion plan over the next 5-10 yrs across businesses ranging from green energy to data centres, to airports and healthcare. The subject fund raise of Rs 20,000 crore would only help contributing 1.7% of the targeted expansion plans.

One should therefore expect lot of new fund infusion, capital structuring news from the Adani group in the short to medium term. The subject FPO might just be a start.

Adani group’s high debt levels has been a point of significant concern in recent times and subject fund raise is also attributed towards mitigating those.

However, at least optically the debt levels in AE seem to be under control. As per the management PPT, AE’s external net debt as at September 30, 2022 stood at Rs 33,517 crore as against the equity of Rs 36,176 crore, i.e. a debt/equity of 0.93x.

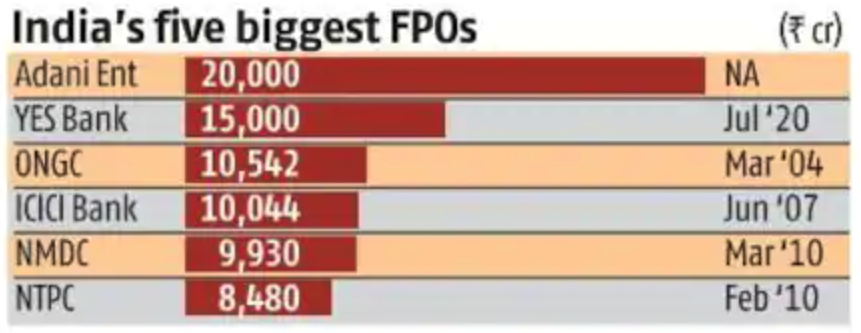

Before closing, it’s also worth noting that this FPO is the largest in the Indian history.