In a market cheering, value unlocking move, Aster DM Healthcare (ADHL) has announced segregation of the India and the GCC business.

- Post-segregation, ADHL will be a focused listed entity holding the India business. The GCC Business will be separated from ADHL to create Aster GCC (AGCC).

- 100% of the GCC Business will be acquired by AGCC (a company incorporated in Dubai International Financial Centre) at an Enterprise Value of US$ 1,651.2 mn (Rs 13,540cr) and Equity Value of US$ 1,001.8 mn (Rs 8,215 cr)

- A consortium led by Fajr Capital will own 65% and the current promoters of ADHL will own the remaining 35% stake in AGCC.

- Please note it’s only the promoters of ADHL that will own stake in AGCC, for which they will be infusing proportionate capital into AGCC. The current public shareholders will, post segregation, only hold stake in the India business through ADHL.

- Promoters expect to infuse the money required in AGCC through the dividend that will be distributed through ADHL (which in turn is majorly from the funds that it will receive from the segregation itself)

- ADHL expects to distribute a significant portion of the proceeds from segregation as special dividend to all it’s shareholders (including Promoters)

- It says that it doesn’t need much to retain for funding the Indian growth

- ADHL’s promoters who own 41.88% of the Company, need funds to contribute towards it’s 35% stake in AGCC

The mentioned objective (as always is in such cases) is to create two distinct geographically focused entities.

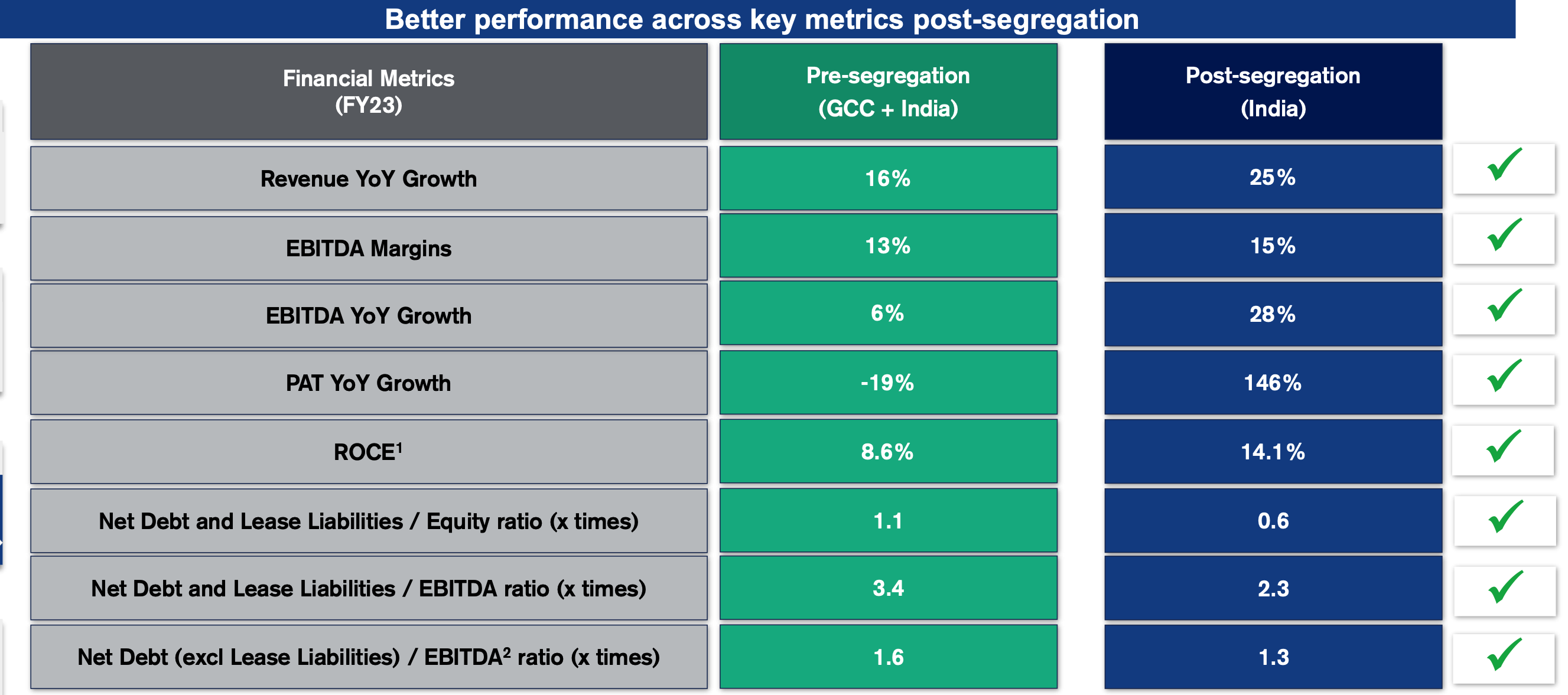

In reality though, it seems an exercise to remove the drag on ADHL’s financial numbers due to the GCC operations.

A key notable fact is – in terms of revenues, GCC operations contributed 75% of the consolidated ADHL’s revenues in FY23 and 72.5% of the consolidated EBITDA. Post segregation, the scale and reported numbers will hence significantly decline.

In H1 FY24, India business reported a PAT of Rs 91 cr. At a current market average multiple of 50x, this would mean a valuation of around 9000cr.

Post announcement, the consolidated mcap has risen to Rs 19,000 cr. Given, the segregation equity value of Rs 8,215 cr, market seems to have more than fully priced the announcement.

Voting advisory firm Institutional Investor Advisory Services (IiAS) has raised concerns on the transaction and advised voting against the transaction.

Key highlighted concerns are –

I doubt that the above concerns will stop the institutional investors in voting against the transaction. They hold 48% of ADHL and are expected to get significant cash as dividend out of the consideration. Besides, they may anyways prefer a more cleaner India focused play for their continued interest in the business.

The Company has informed that the board will consider distributing 70–80 percent of the upfront consideration as a dividend to the shareholders.

With this update from the Company, IiAS has also changed it’s advise on the transaction from “against” to “for” (Whatever happened to it’s other concerns on the transaction is anybody’s guess)