HDFC Life has been an under performer for last 2 years – in October 2019 it reached a high of Rs 644 and is currently trading at a price of about Rs 690.

There are multiple reasons for the underperformance including Covid related concerns on the life insurance business as well as factors specific to HDFC Life. Standard (JV partner) has consistently pared it’s stake from a high of 29.23% in December 2018 to 3.89% as on September 2021.

However, it seems the stock may be bottoming out for the near term unless there is sell off in the broader markets.

Reasons

- Standard is now left with just 3.89% with related lesser supply pressure on the stock price. Currently, Standard’s focus seems to be more on pairing stake in the AMC business.

- With Covid ebbing, related uncertainties should be reducing for the life insurance companies. Broader industry prospects continue to be favorable for the life insurance business in India. A related article.

- Risk averseness is slowly creeping into the stock market and rotation should benefit stocks like HDFC Life.

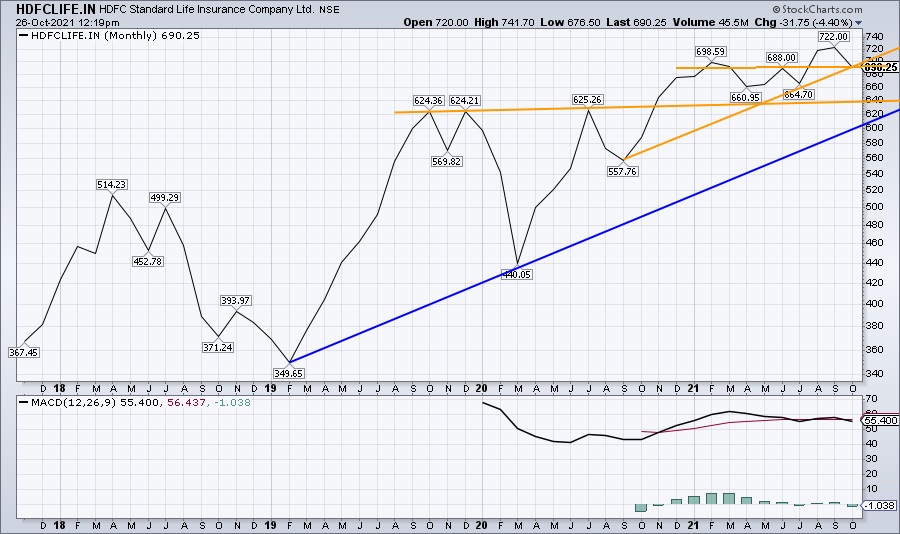

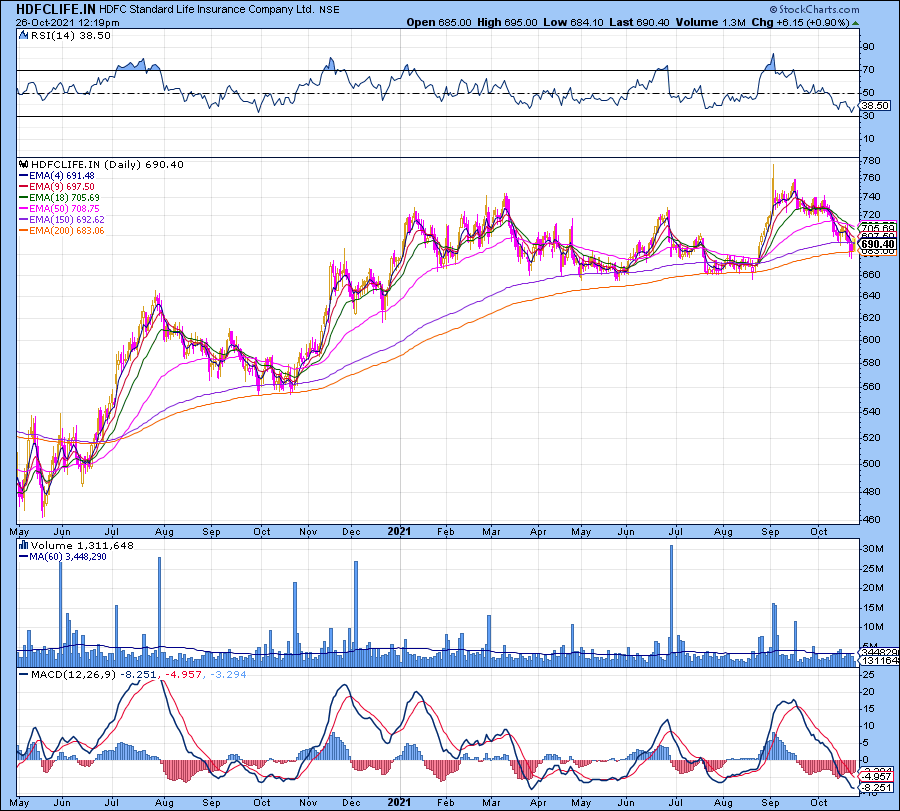

- Technically also, stock is closer to it’s long term and short term support levels.

On long term the stock is testing it’s previous highs and short term it’s closer to 200 day moving averages.

All variables are indicating that stock should take a support here atleast for the short term.