In May 2021, Godrej Consumer Products Ltd (GCPL) had announced hiring of HUL veteran Sudhir Sitapati as MD & CEO. He joined the Company in October 2021.

Sitapati has replaced Nisaba Godrej from the Promoter’s family, who was holding the position temporarily after Vivek Gambhir had quit in the previous year. Nisaba however continues as the Executive Chairperson of the Company. Practically she is Sitapati’s boss and I would believe for many practical purposes also the final authority. It’s important to mention here that the Promoter Group currently owns 63.2% of GCPL.

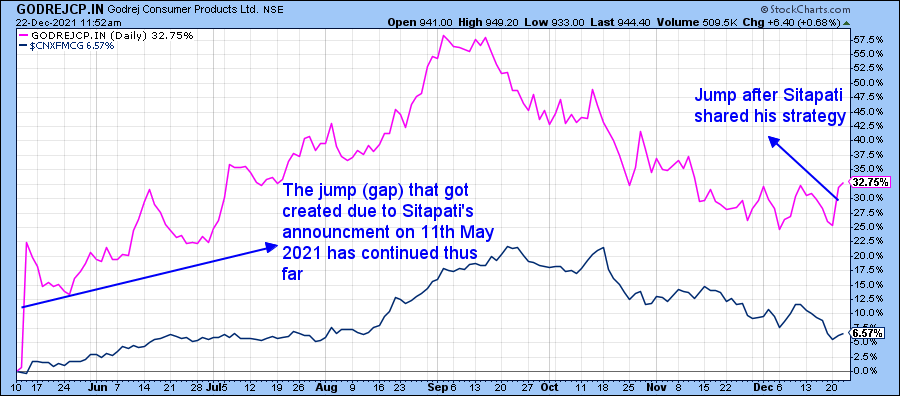

In May, when the announcement of Sitapati’s hiring was made, the stock price in 1 day had increased by >20%. Following is GCPL’s stock price performance vs FMCG index since his hiring.

As was widely awaited, the new MD shared his strategy on December 20, 2021. Details can be referred from the attached PPT.

For ease, I am summarising the key points.

- Aim for double digit volume growth in the medium term (3-5 years). For comparison, volume growth has been around 9% during FY 21 and H1 FY22.

- High volume growth to be achieved through deeper penetration of the existing popular brands. As per company estimates, it has a tendency to stop at around 20-25% penetration in the fear of getting downgraded (I don’t really know what that means). As per Company, deeper penetration can contribute 50% of the future targeted volume growth. Assuming this to be true would mean a target of around 15% volume growth in the medium term.

- Deeper penetration to be achieved through greater focus on key products and increased marketing.

- Target to achieve a 150-200 basis point margin expansion through cost rationalisation and increased automation.

- Greater focus on fewer but bigger innovations.

If I have to summarize everything in few words – it’s a more focused hands on approach that the new MD seems to be aiming for.

How much a free hand he gets to do so – only the time will tell. Most of the times a focused approach requires very dull and boring decisions, which is not what GCPL is known for.

The Company has also warned about the continued challenges related to the inflation and it’s consequent impact on the short term performance.

Under the circumstances, how much patience street itself has on GCPL’s new approach would be interesting to watch.

In terms of valuations, the stock at trailing P/E of >50x is comparable with peers as well as it’s own historical valuation band. One cannot really call it a value buy. Yes a significant outperformance vs expectations can expand this band – however, the current environment is unlikely to provide that impetus.

What Sitapati’s PPT might really do – provide a cushion against any major correction in the short term !