Brightcom has informed about the subject to the exchanges on February 28, 2022.

Key points to note –

- SEBI had sent a letter to the Company on September 16, 2021, asking it to conduct a forensic audit.

- “The Securities and Exchange Board of India has reasonable grounds to believe that the disclosure of financial information and business transactions in the matter of Brightcom Group have been dealt in a manner which may be detrimental to the interest of the investors or the securities markets,” said the said SEBI letter.

- The regulator has appointed Deloitte to conduct the audit.

- The Company said that the forensic audit is to verify the ‘Impairment of Assets’ in 2019-20 and the charge taken thereon.

- The Company sees no wrong doing in the said impairment charge. It said that it’s a non-cash charge and was taken by the Company due to the Global Data Protection Regulation (GDPR) in Europe and it’s applicability worldwide.

- The company represented to SEBI that the said audit was unnecessary because several internet companies had to take such charges globally, owing to the GDPR norms.

- SEBI however on 25th February 2022 intimated the company that this audit would be necessary and hence finally the disclosure by the Company.

It’s difficult to comment based on the facts, whether there are any accounting misrepresentations, siphoning of funds or anything else objectionable by the company. However, few points are worth noting –

- More than 5 months delay in informing about a SEBI notice to public conveys a lot about the corporate governance standards at the Company. It should have been disclosed immediately in September itself even if the Company intended to oppose it.

- The Company in general has a very checkered history. Earlier it was known as Lycos and I remember many analysts, private equity funds being bullish on them. This was somewhere in 2010-11.

- However, subsequently the company started to become a blackhole for most. Main reason – too many big talks and difficult to understand the fund flows.

- The Company again came to public notice in recent times, after the stock price moved from Rs 4 in November 2020 to a high of Rs 204 in December 2021 i.e., 51x in a year.

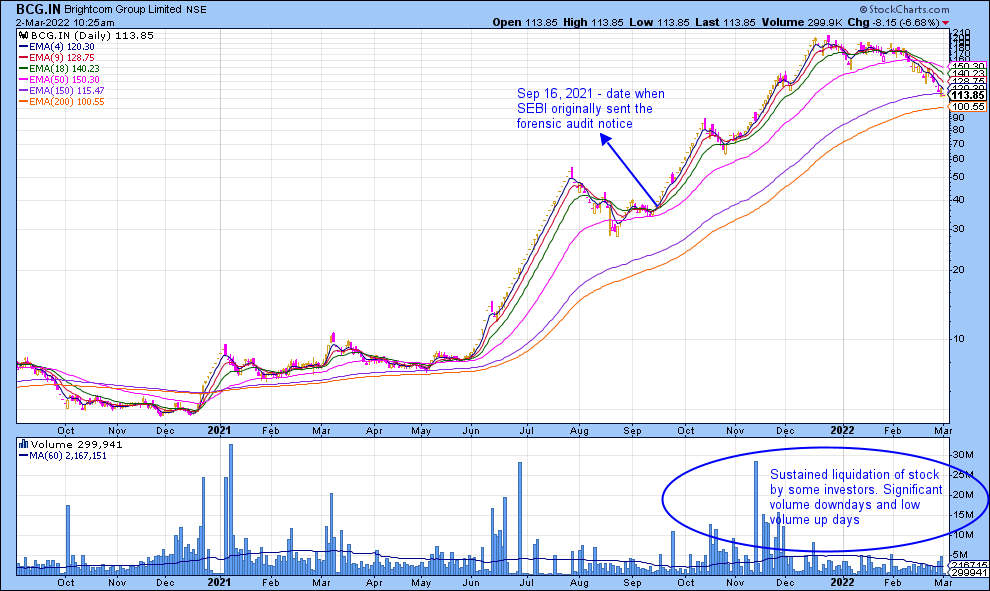

- At the time when SEBI notice was originally received, the stock was trading at around Rs 40 and from there increased to 5x within the next two months. However, as is normally the case in these situations, some big volume exits happened during this period. Have a look at the following chart: