After Vodafone Idea (VIL), Tata Teleservices Maharashtra (TTML) now opts for this conversion.

For VIL, it made sense (check the article). However for TTML to opt for this is highly confusing and mysterious.

Why?

- The interest amount that TTML had to pay was only Rs 850 crore. For Tata group this is nothing.

- In lieu of this amount, TTML is allowing govt to hold 9.5% stake into the Company. On the date of this announcement, TTML’s market cap was Rs 57,000 crore implying govt’s stake to be worth about Rs 5,388 crore i.e., 6x of the liability amount. Why would Tatas pay more than what was needed?

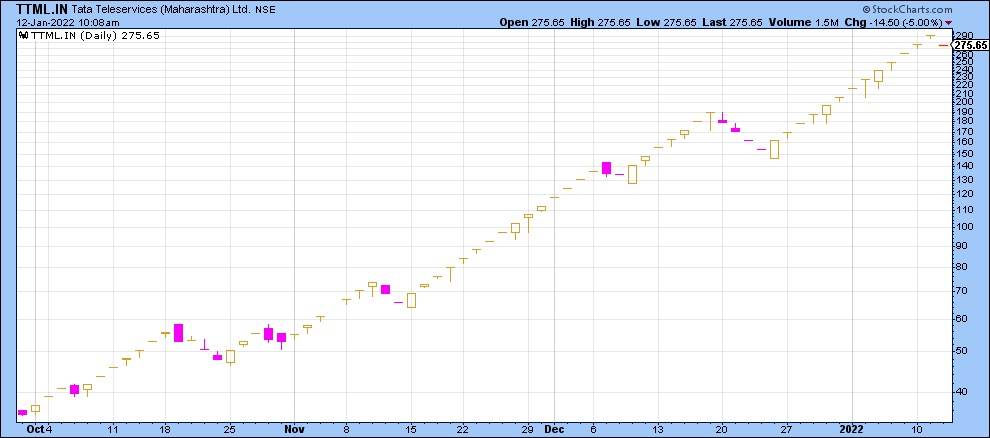

Surely, one can argue that TTML’s stock price had a spectacular run in recent times and hence it may not be the correct calculation. Share price had increased from a low of Rs 1.8/ share in March 2020 to Rs 291/ share as on the date of this announcement i.e., 161 x within 22 months. In last 3 months, the stock has increased about 7x.

However, this argument creates more mystery.

- The equity conversion to govt is at Rs 41.5/ share. Is this the real worth of the share as against Rs 291/ share on the date of announcement?

- If yes, how did the share run up so much so fast? Who was buying/ selling and what was the rationale that they saw which Tatas themselves can’t see? As at September 2021, Tata Group owned 74.36% of the equity and balance by public.

- It’s important to mention here that the run up in this stock was unlike anything seen in the reputed corporate group stocks. These kind of price moves are more common in small cap unknown names. Checkout TTML’s stock chart since the recent run up started in October 2021.

I am personally clueless to figure out what is happening and why.

Guess, only the time will tell and then I can do the hindsight analysis 🙂

Note: It’s only Tata’s approval for conversion into equity. Option now lies with the government to accept this or not. Government, at its sole discretion, may convert any part of such loan to preference shares instead of equity shares and such preference shares may be optionally or compulsorily convertible and/or redeemable and/or participating in nature. The price of any preference shares for the purpose of conversion of the loan shall be equivalent to equity shares.

Update February 1, 2022TTML has withdrawn the conversion option.

Reason:

- Interest calculated by Department of Telecommunications (DoT) is significantly less at Rs 195.22 crore compared with Rs 850 crore that was calculated by TTML.

This update further adds to the confusion –

- For the 1st time, I have come across calculation by a government agency being lesser than the Company.

- Even if it’s less, TTML should be happy that they would be giving less stake to the government – approx 2.18% for Rs 195.22 crore compared with 9.5% that they were giving based on their self calculation of Rs 850 crore dues.

It’s worth noting here that TTML has been seeing a continuous lower circuit since the previous announcement was made and share price has almost halved to Rs 142/ share. Though it still as of now is higher than the Rs 41.5/ share indicated conversion price for the government.

The mystery only further deepens and one needs to keep in mind that this is a Tata Group company – so all the more confusing.

General consensus is that share run up in TTML has allowed Tatas to dilute less to govt.

However, that’s assuming government is a sitting duck. Very unlikely so.

I have my own opinion about why it happened what happened. However, no point in speculating as of now. I believe all of us will be surprised with what will happen.

I watch for the events as they unfold.