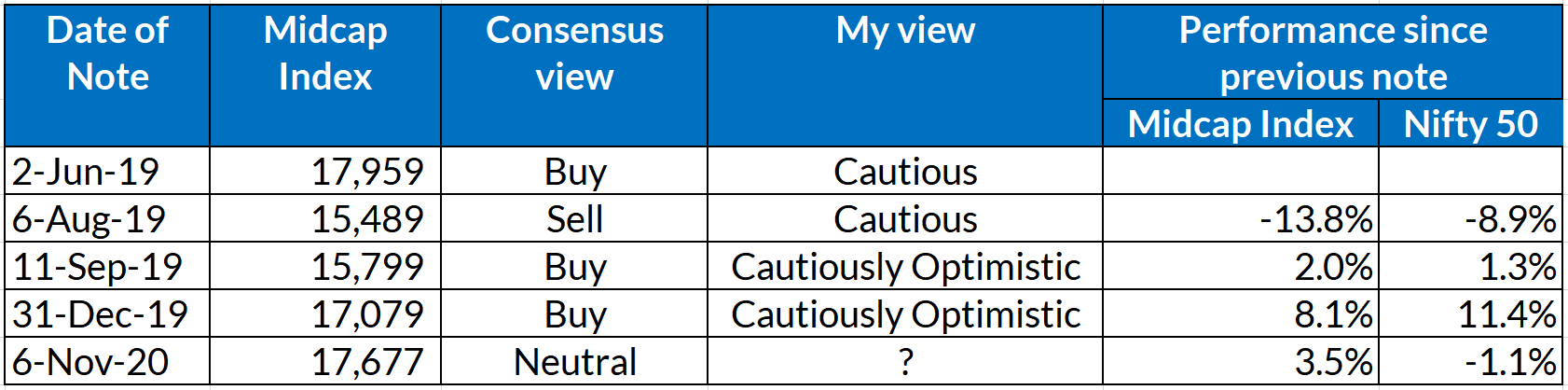

My previous posts on the topic –

It’s been almost a year since I wrote on this topic !

Reason – Covid and uncertainty around it. Frankly, so much was happening that I just couldn’t focus and write specifically on mid-caps.

Instead, from April to August, I published four articles on Covid and its impact on stock investing and the Indian economy. Link for the last article – COVID2019 and stock investing – Part 4 – is it a blessing in disguise for the Indian economy !

Coming back to the current topic – mid-caps….

Have a look at the following performance comparison chart of mid-caps and large-caps since my last article on the topic.

Key points to note –

- Mid-caps had finally started outperforming large-caps. However, then Covid happened and they fell in line with the broader markets. Important point to note is that the fall was in tandem with the large-caps and not steeper as one would have expected given mid-cap’s high beta (riskiness).

- When recovery also happened, mid-caps didn’t lag behind and moved in tandem with the markets. This should again be surprising given that one would have expected mid-caps to under perform due to Covid related uncertainties on the businesses.

- On the contrary, since June, mid-caps have again resumed their out performance vis-a-vis large-caps, albeit marginally.

Mid-caps so far seemed to have weathered Covid pretty well and investors don’t seem to be overly concerned

I don’t think anyone who is an active investor predicted this and if someone did, you should become his bhakt ! Please also mention his name in the comments, so that I can also start listening to him more carefully 🙂

In hindsight, this is what I believe happened –

- All of us over estimated the impact of Covid. With support of debt moratorium/ restructuring by government and prudent costs control, businesses weathered the storm reasonably well.

- While some sectors faced significant headwinds (e.g., hospitality, theaters, restaurants, airlines etc), they got compensated with continued expansion/ revival of other sectors (e.g., IT, pharma, auto, consumers etc).

- Midcaps were already under performing since Jan 2018 and many of the stock were heavily beaten down. In Covid led fall, stocks saw more deep cuts but then value buyers jumped in to support them.

- Rural economy did much better than expected because of good rainfalls and less impact from Covid.

- Urban faced job losses and reduced incomes but many of that is proving to be temporary. Besides, low household expenses during lockdown helped keeping the hopes alive.

- Liquidity support continued globally, ensuring no sustained panic selling. Besides, Covid being a global phenomenon with zero capability of anyone to differentiate the impact between different countries, all global markets moved in tandem.

What now? Time to become aggressive towards midcaps?So far Covid is proving to be an extraordinary line item in the P&L and not a structural long term damage.

Post Covid led fall and recovery, we are back to our previous highs and confusion is now more than ever.

Midcaps to outperform need an overall positive sentiment both in terms of economic environment as well as fund flows. Let’s checkout some key factors impacting those –

1. Indian economy

My regular readers would remember that I have been cautious on Indian economy for last many years. Initially I was negative and then later half of last year I started turning little positive. Reason – poor and then marginally improving sentiments due to varied reasons (you can refer my previous articles).

Then Covid happened and everything got reset !

I personally consider Covid to be a blessing in disguise for the Indian economy and hence have now turned positive.

- Primarily, because it has provided structural tailwind to two core sectors that were languishing for long – auto and real estate. These two sectors have huge broader economic linkages. (for details on this please refer my previous article here); and

- Secondly, given China angle (Covid as well as border standoff) it has suddenly made us look more within ourselves and others into us… the result… it has prompted us to try become an alternative to China. We therefore would surely announce some businesses friendly policies. After a long time, I am actually bullish on next year’s budget announcements. Yes, fiscal deficit would be a dampener but investors will ignore it due to Covid.

“India’s economy needs a way out of short boom-and-bust cycles”. This has been a fact for last many years and the two points mentioned above can potentially change that.

2. Domestic and global fund flows

I am more bullish on global flows and less on domestic. Global fund inflows can create a sustained significant momentum.

Global funds follow economic performances and hence are bound to come if the economy plays on. Yes, there are significant risks associated with global financial markets due to easy monetary policy and if it were to correct there is no way we will be spared. However, Covid has created this necessity in the mind of global monetary authorities that they need to continue providing supportive monetary policies and hence it’s difficult to predict when will it start reversing.

Best case scenario for India is that we don’t see any sustained panic selling globally.

Domestic funds may be muted in the short term as in general people are more cautious and have not made money in the financial markets over the last 5-6 years. I personally believe there is some rotation of money that would happen from financial assets towards physical assets in the short term, before economic prosperity led wealth start coming back.

3. Low cost of debt

Indian policy makers have been trying to reduce costs of funds for some time now. Policy rates were declining without much pass through – especially to the mid-caps. This was primarily because banks were busy cleaning their own books and hence had very little margins to work around with.

Covid in a way has again helped changing that.

Notwithstanding the cleanup that had already happened, Covid has provided the much needed defense both to the policymakers and the institutions to work with less than perfect banking sector books. Moratoriums, deferments, restructurings etc are what I am hinting at.

Besides, Covid has also made retail lending in the short term somewhat doubtful (given job losses, salary cuts etc). Under the scenario, banks have started looking at corporate lending more aggressively, benefiting mid-caps at large.

4. Valuations

Indexes are only back at pre-covid levels when in any case mid-caps were trading at 14-15x 1yr fwd multiple vs 19-20x for large-caps.

One can safely assume those multiples to be true even now ignoring the extraordinary dip due to Covid.

On the contrary, with economic revival the forward multiples should be further more comfortable.

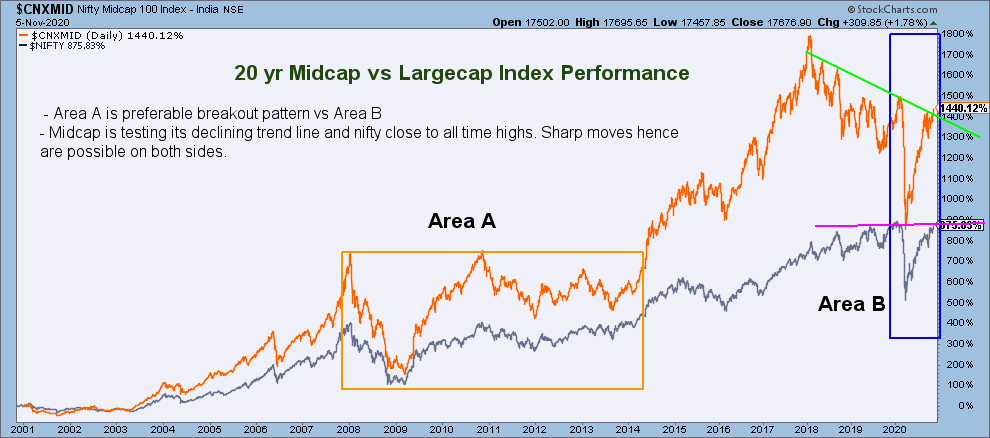

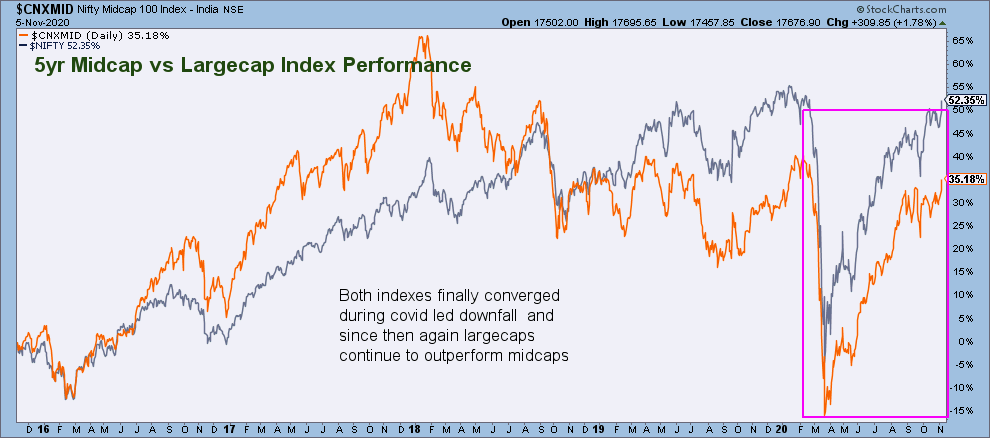

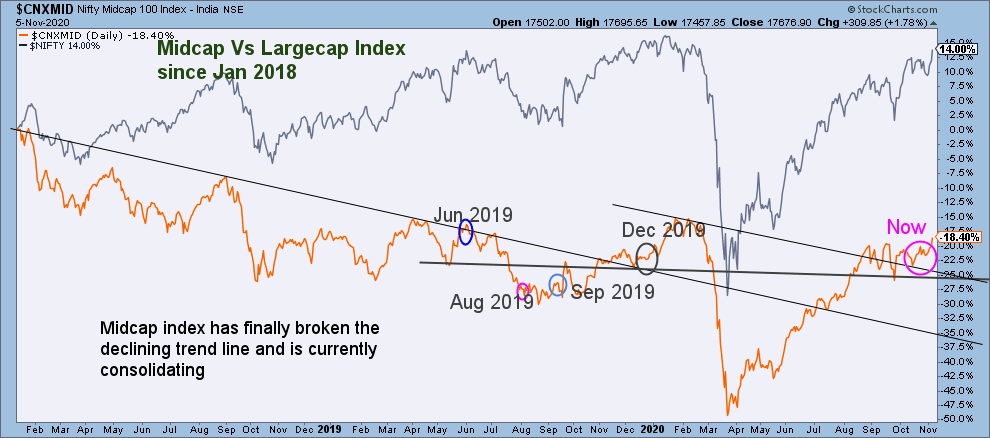

5. Technical Charts

On medium time frames, large-caps continue to outperform mid-caps. However, the good thing is Covid made them converge and as highlighted in the very 1st chart in this article, mid-caps since the beginning of this year have acted less risky and are trying to emerge stronger.

Technically, volatility is still very much possible. However, that should further strengthen and not weaken mid-caps going forward (sort of change in the underlying trends).

6. Points of caution

- Covid has not gone yet – as of now we are talking about 2nd wave, then maybe 3rd, 4th and so on. The fact remains distribution of vaccine to public at large is still at least a year away and only time will tell efficacy of the vaccine. However, personally I believe we are done with the most uncertain phase and going forward notwithstanding hiccups, the fight should be more predictable and manageable.

- US elections – at the time of writing this article, counting is still on and the race is too tight. The market should be ok with anyone except maybe a legally challenged and controversial selection, that can potentially lead to social unrest and hence nervousness in the short term.

- India China border dispute – if escalates, can have a significant impact. No one can predict the timing or extent of this and we will take it as it comes.

- Companies with significant debt – I will personally avoid those and especially of smaller size and those with working capital management challenges.

Considering all the above, I am now turning “Positive” on midcaps.

Needless to say, I will keep my guards on and not be over keen. However, I will be more sector agnostic and may venture towards non defensives.

Disclaimer: Above are my personal opinions and not any recommendation. The reader should do his own research before making any investment.

Illustration Credit: Vecteezy.com

Informative article