Some Banks/ NBFCs have already reported the results and many more will follow soon.

Headline numbers have been mostly strong especially when looked in the backdrop of extensive lock downs and consequent economic disruptions during the quarter.

- Growth is muted (but not fallen off the cliff);

- Asset quality seems to be under control;

- Net Interest Margins (NIMs) are mostly maintained; and

- Profitability has been good

As a result, most of us especially retail is pleasantly surprised and wondering whether the worst is behind us and it’s business back to normal. Because if it is, then most banks/ NBFCs are still available well below their pre Covid highs and therefore it might make sense to accumulate them.

I will suggest… don’t rush… strictly follow your defined strategy… it’s too early to imply anything !

June quarter numbers actually indicate nothing on any parameter.

Growth – growth in banking for me means growth to support economic activity/ expansion. Economic activity during the quarter was highly disrupted and hence there were minimal business expansions (especially in the sectors that borrow).

Most of the borrowing that happened during the quarter was towards survival and not growth

- in case of companies – they needed money to meet the fixed expenses. Hence, lenders didn’t have choice but to further lend to their existing leveraged customers (otherwise they will further deteriorate). Besides, some entities who otherwise would have met their expenses from internal accruals also had no choice but to borrow.

- in case of retail – other than agri/ rural, given the uncertainties around jobs, pay cuts, neither customers nor lenders were too keen to transact.

Asset Quality – Loans were under moratorium through out the June quarter. Moratoriums still continue and are currently applicable till August end. Most likely, based on murmurs around, there would be a further extension till December end and who knows then maybe even till March 2021 !

Remember, Indian financial sector even pre Covid was going through a challenging phase and regulator for the last couple of years has been considerate on various counts. Given that and the current situation, I really don’t see a sudden switch on and switch off scenario.

No analyst, economist or maybe even regulator can possibly comment on the exact situation with confidence

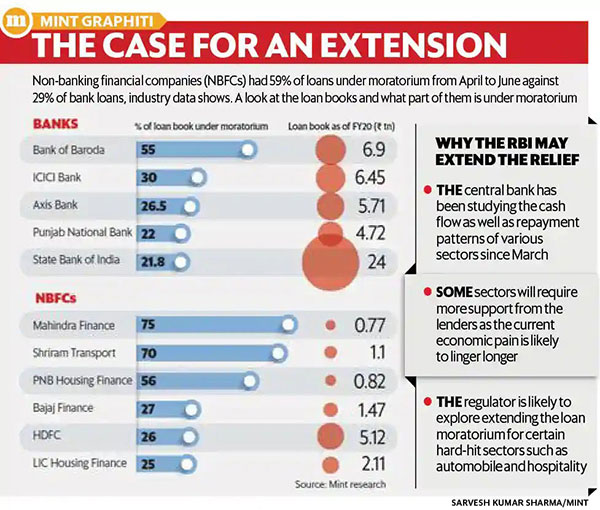

Yes, we do get some details on the percentage of loans under moratorium from time to time. E.g., checkout below

Yes, the above is useful. However, in no way does it help me to understand the current asset quality or make any predictions about the asset quality of any lender over the next few quarters. Reasons –

- Economic situation is still not back to normal and lock downs of varied types still continue. Most businesses continue to operate at sub optimal levels.

- Covid2019 still continues unabated and time and again we keep on hearing about threats of second and third wave.

- Initially many opted for moratorium but then there was confusion of interest accrual or not. Once, it was clear that interest would be accrued, many started digging out of their savings and started paying.

Under the above scenario, businesses (who are already stretched) paying today may not necessarily continue to pay tomorrow. So how does anyone even make a calculated guess !

Growth and asset quality are two key parameters for me to analyze any lender. Others like NIMs and profitability are majorly dependent on these two. Hence, I would personally not focus too much on anything else under the current conditions.From a general perspective, this is what is happening around NIMs and profitability –

- Banks especially the strong ones are flush with customer deposits increasing the overall money to lend.

- On the lending side, pre covid everyone was focused towards retail lending vis-a-vis corporate lending. This was due to muted economic situation and hence struggling corporate balance sheets. Post Covid, as mentioned before, lending seems to have shifted towards corporates and that too only survival and not growth.

- Overall interest rates have continued to decline over the last few years. This has been quickly passed through by lenders on the liabilities side (i.e., cost of the money they borrow) and not so quickly on the asset side (i.e., income on the money they lend). This is due to varied reasons and is more specific to the prevailing market conditions where the whole system is under stress and there is no real competition to lend especially to the tier 2 borrowers.

- Deteriorating asset quality has been a major issue for the Indian lenders since 2015 and Covid2019 has further worsened the same.

- Given the struggling growth and asset quality, most Indian lenders have worked hard to control other expenses/ costs over the last few years and continue to do so. Hence, this seems to be reasonably well under control.

Read the above carefully and you might agree to my earlier proposition that growth and asset quality are the only two key parameters that one should be really bothered under the current conditions. On both counts, there seems to be no clear answers.

Obviously, this sector is integral to the overall economic growth – both as a cause and as an effect. Hence, it needs to come clean sooner than later. How that will pan out, remains to be seen.

For now, it’s hiding more than it’s disclosing

Disclaimer: The above are my personal views and not any investment recommendation to the reader. Please do your own independent research before taking any investment related decision.

Illustration Credit: Vecteezy.com