I got first exposed to equity investing way back in 2000 during my Chartered Accountancy (CA) days. Since then every book I read and every person that I met – the general learning and discussion has always been centered around identifying good companies to invest into. Even today, the starting point (and mostly the ending point) of any conversation on the subject is – which stocks should one buy !

All of us have Warren Buffett as our role model and how he accumulated his wealth investing into good strong businesses. Logically therefore, the value of identifying and investing into good businesses can not be disputed.

Can it be ? obviously not…

Underlying meaning of investing itself is to buy something that can grow over time which can only happen if the business is good

So then why undermine stock picking?

Please read the title again… I nowhere undermined it… I only said it’s not the key !

And this realization happened to me couple of years back only when I was trying to reflect on my past experience and performance. Reasons –

- Despite a very good stock picking record, I was only delivering mediocre returns

- I was not alone, the situation was same with most others that I knew or whose performance I was tracking. The exceptions per se were far and few. Let me also state here that over the years, I have interacted/ known/ observed some of the best minds in this industry.

And what’s the main reason for this under performance…

We over estimate our capability to pick the winners and then become emotionally attached to them. In the process we forget to differentiate between winners and losers and somewhere lose control of our capital management and hence returns.

- In general, the ability of anyone to pick winners vs losers ranges in between 40% to 60%. That is 4 to 6 winners out of every 10 stocks that he chooses. I don’t know anyone who is better than 60%. I also don’t know anyone who is worse than 40% !

- However, we become complacent and believe that every stock that we have picked has to win and there is no other way.

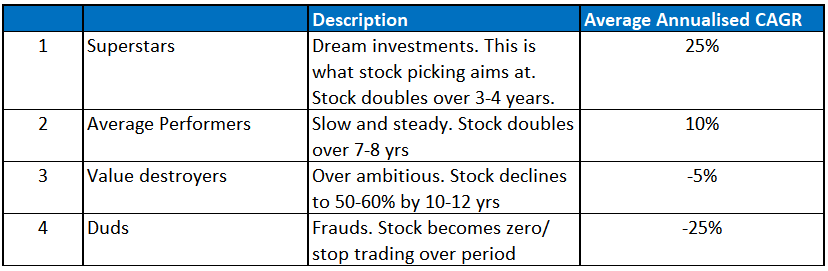

Following are the four kind of stocks that most of us typically end up investing into –

Likewise, I have come across four kind of investors over the years as detailed below.

Further details are member exclusive Pls Login

If you are still not a member Sign-up – Membership is free ! and you get access to this and other interesting, to the point, useful stuff.

There are many additions we regularly introduce for our exclusive members. They are the first ones to get any new information + get access to exclusive articles/ updates + are never time barred.

Illustration Credit: Vecteezy.com

Good article …Nitin…this exactly makes a difference in consistency and long term goals.

Brilliant analysis, Nitin!