Current Market Caps (August 23, 2021)

- Bombay Burmah Trading Corporation (BBTC) – Rs 8,239 cr

- Britannia Industries – Rs 93,841 cr

BBTC’s stake in Britannia is currently worth more than Rs 40,000 crore i.e., almost 5 times of it’s total current market cap.

As such, it’s not unusual for holding companies to trade at a discount to their underlying investment value. Reason – no one expects them to sell their stake and return the money to the shareholders so value as such is notional – or atleast it’s considered to be.

However, what is unusual is the quantum of discount. Most holding companies over years settle at a particular discount levels to the underlying investment value and become attractive to invest when that discount becomes too high.

Another way to put the same thing is – over longer periods, returns of both the holding company and the invested Company tend to mirror each other. So, though the discount would still be there but the returns would not be drastically different.

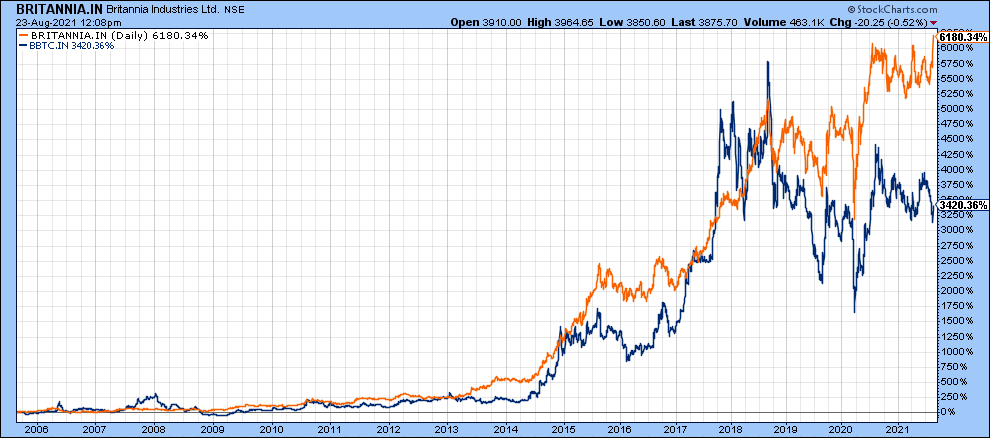

Have a look at the following return comparison for BBTC and Britannia shares over last 16 yrs.

- BBTC for periods maybe under performing Britannia. However, then it catches up sharply.

- BBTC moved very quickly from 2016 to 2018 and then went into technical correction followed by covid related concerns related to the group’s aviation business (Go Air).

As can be seen from the chart, recently gap between BBTC and Britannia has significantly widened – again maybe due to the concerns around Go Air. It’s important to note couple of points here –

- As at March 31, 2021, BBTC’s balance sheet showed an outstanding loan of Rs 425 crore from Go Air. This must have been to to support the airline business during the year. In the previous year, the amount was negligible.

- Group has filed DRHP to take Go Air public. However, the same is pending approval from SEBI and the clarity is only expected to come by September 2021 end.

On all counts, it seems airline business is a key determinant to BBTC’s share price going forward. Britannia’s business as such is not a concern and company continues to do well.

Other key points to factor in –

- BBTC’s shareholding pattern will support the share price performance. Promoters control almost 74% of the Company. Low float therefore can lead to significant movements in short period.

- BBTC’s own stock price chart is in a tight consolidation phase and is trying to break out. Have a look…

Stock seems to have broken out of the long term trending line and is currently retesting it. Post 1400 levels, the stock can move very quickly.