Britannia has been an average performer over the last three years. As against a high of Rs 3,270 in August 2018, share is currently trading at Rs 3,686 i.e., a return of just 12.7% in more than 3 years.

During the same period, FMCG index increased by 18% and nifty by 56%.

Reason for Britannia’s underperformance –

- A significant part of that can be associated with FMCG index’s under performance. The same is because of recent uptick in the cyclicals resulting in rotation of investor’s money towards more risky sectors e.g., real estate, metals. FMCG being defensive always performs with a lag during such periods.

- Recent uptick in the commodity prices resulting in margin pressures for FMCG sector in general.

- Britannia specific concerns related to the Promoter Group (Wadias).

Why Britannia looks a more safer bet now?

- Markets seem to be getting into an overbought zone. Under such situations, it would be reasonable to assume rotation back towards the defensives e.g., FMCG and Pharma.

- Input price pressures – most FMCG companies have started increasing the final product prices. A significant impact of the same should start reflecting in Q3 FY 2022 onwards. Besides, input prices are not sustainable at current levels. Beauty about FMCG business is that they rarely reduce their prices when input prices decline – resulting in structurally higher profits and margins.

- Group concerns – a significant reason for the concern is money sucking Go Airlines business. Two factors should negate this –

- with covid ebbing, airline business overall is picking up very fast and the same is expected to pick up more significantly (revenge traveling) over the short to medium term.

- Go Air is also in the process of going for IPO for which it has received the SEBI approval. Once IPO is done, the group entities should see rerating by the investors.

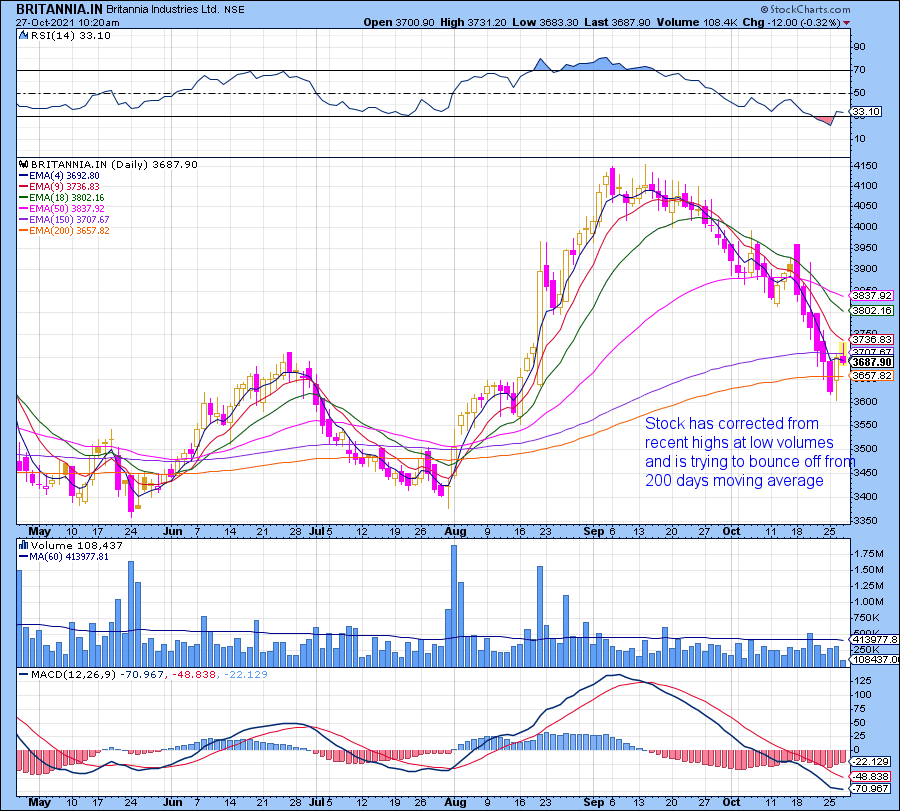

- Technically, the stock seems to be closer to long term and short term support levels.

One factor to keep in mind is the overall FMCG index. It still can see another 12-15% of correction. If there is significant panic driven selling in the FMCG stocks, Britannia may see decline as well.

Overall, Britannia may be turning into a buy on dip stock !