Crompton had acquired controlling stake in Butterfly last year. For details check here.

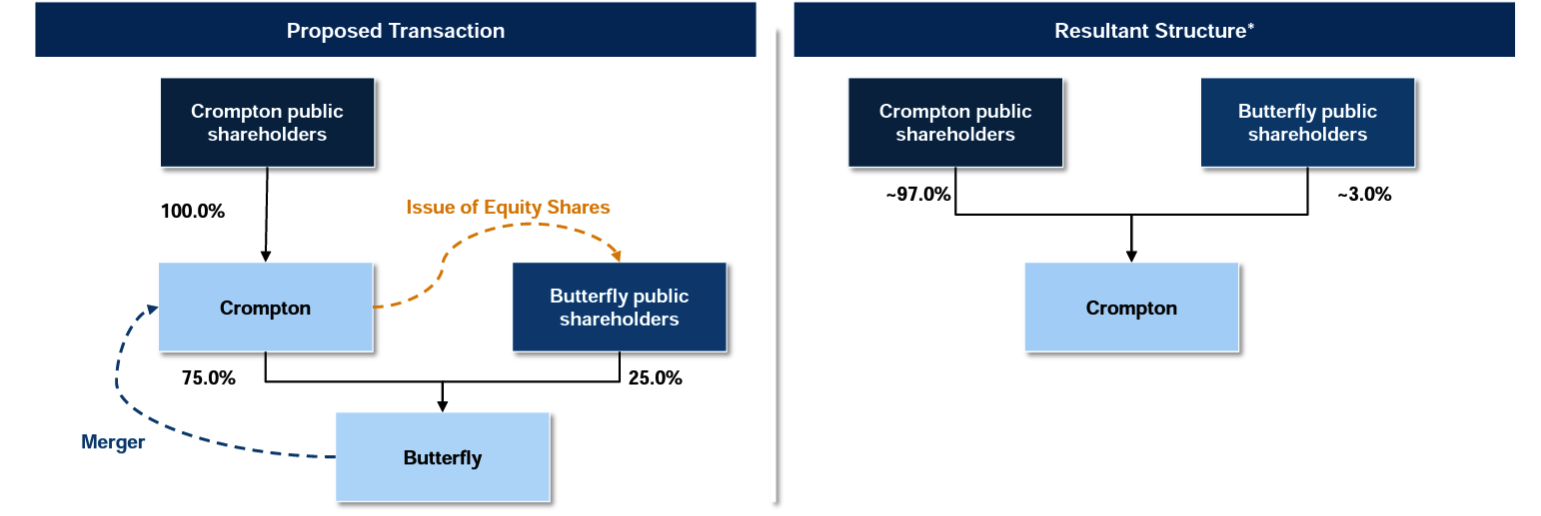

Currently, Crompton owns 75% stake in the Company, previous promoter group 7.78%, DIIs 5.61% and balance 11.58% by public.

Crompton has now decided to merge Butterfly within itself. Consequently, there would be only one listed entity i.e., Crompton and other shareholders of Butterfly would be given 22 equity shares in Crompton for every 5 shares of Butterfly.

Post transaction shareholding structure of Crompton

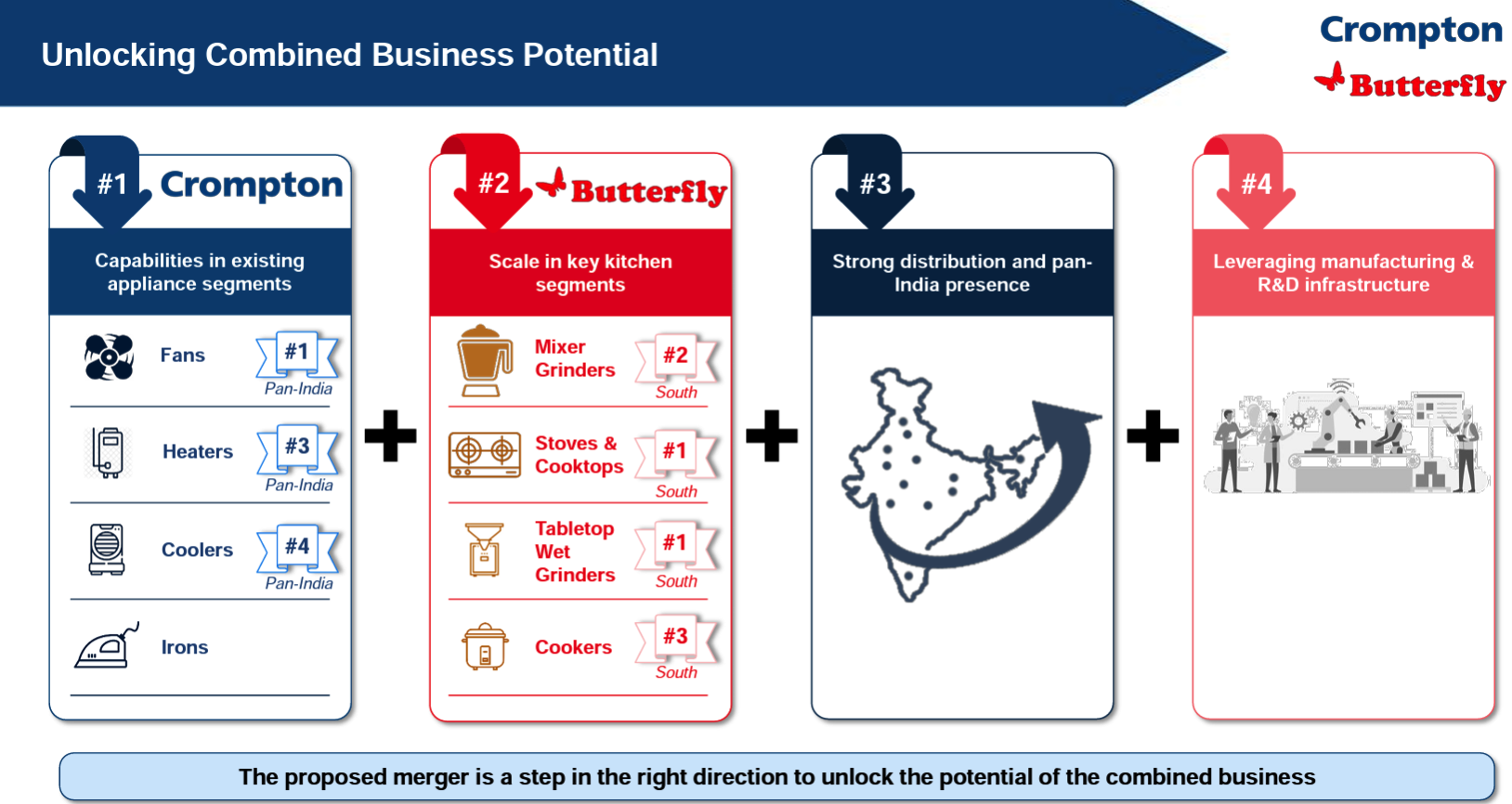

Rationale of the merger

Synergies.

Merger is subject to the requisite approvals and is expected to get completed over the next 12-14 months.

Merger got rejected by shareholders and hence can’t be acted upon.

The merger required two shareholder approvals.

It’s the second approval that didn’t come through. 72.61% of public shareholders voted against the merger.

As per the Crompton’s statement – “This development will not have any significant change in our growth strategy. The companies will continue to operate as separate entities and work towards fulfilling their mutual strengths while they grow the kitchen appliances category in order to achieve the growth potential of each of the companies, thereby creating value for all the stakeholders.”

https://www.bseindia.com/xml-data/corpfiling/AttachLive/fe5b2f53-0ce7-4094-8b03-aa4db141814e.pdf