After years’ of speculation, HDFC group today finally announced reverse merge of HDFC Limited (HL – the mortgage arm) into HDFC Bank (HB).

Listed below are some key factual points for your perusal.

- Shareholders of HL will receive 42 shares of HB (FV Re. 1/- each) for every 25 shares of HL (FV Rs. 2/-each). Previous trading day’s closing price of HL was 2,452.30. Based on the conversion ratio, the same means a value of Rs 1,459.70 / HB share (2,452.3*25/42). HB’s closing price on the previous trading day was Rs 1,506.

- Transaction completion is subject to shareholders, creditors and regulatory approvals including from RBI, IRDAI, CCI, SEBI and Stock Exchange. Closing of the merger is expected to complete by Q2/Q3 FY 24 i.e., max by December 31, 2023 (almost 21 months from now).

- Post completion, HB will be 100% owned by the public shareholders and existing shareholders of HL will own 41% of HB.

Some important consequences of the merger

- Businesses like HDFC Standard Life, HDFC AMC etc, which are currently owned by HL will instead become significantly owned and controlled by HB. This should positively impact these businesses (due to more focused cross selling to HB’s customers and branch network).

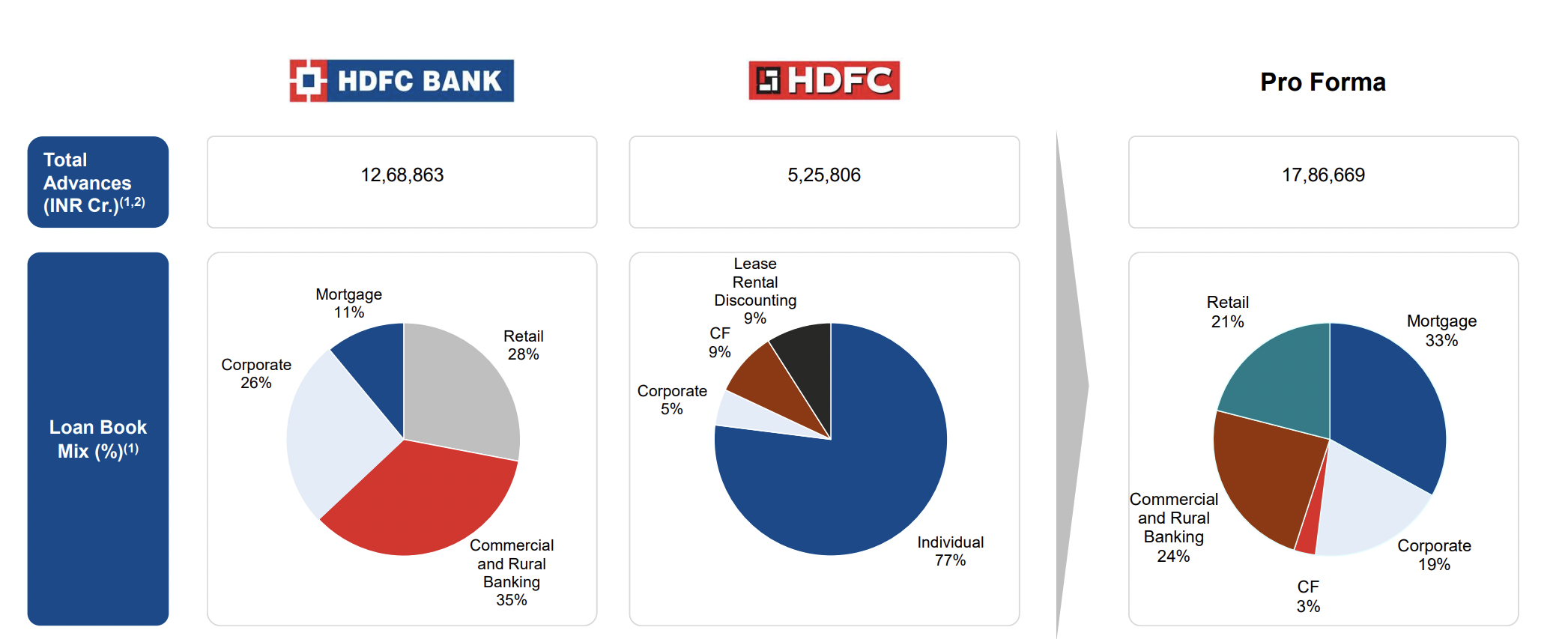

- Asset mix of the combined entity will change significantly towards retail (54%). Infact, mortgage alone would become 1/3rd of the total loan book (based on current numbers). It may make sense to start calling HB a mortgage bank post merger.

Infact, HL itself has acknowledged it’s bullishness about housing demand in India to be one of the key reasons for the merger.

- In terms of Capital Adequacy Ratio (CAR), situation is expected to continue remain comfortable. HB’s current CAR is 19.5%. The same stands at 19.8% if HL and HB are combined today.

Overall view on the merger

Given the size and scale of the transaction, it’s difficult for me to form a view immediately. I would look to gain more and more information as we move forward. The fact remains –

- Merger is still 15-18 months away.

- There are senior key people involved at both the entities. How roles and responsibilities are allocated between them, would be an important metrics to gain clarity upon.

- Even on ground merger of physical infrastructure and human manpower for such scale would need a very careful execution.

Scale of the transaction and complexities involved can also be inferred from the number of advisors employed by both entities.

Under the situation, neither I am in a hurry to come to a conclusion and nor buy/ sell the shares of any merging entities !

Some important views/ information that have come through since the announcement.

HDFC Bank’s CTO says, it’s not tough to integrate IT systems of HDFC bank and HDFC Limited.

This is one of the key deliverables for a smooth rollout.

Some further key updates –

RBI has allowed HB or HL to increase the shareholding to more than 50% in HDFC Life Insurance and HDFC ERGO, prior to the effective date of the merger.

“Investments including subsidiaries and associates of HDFC Limited are continued as investments of HDFC Bank,” said the bank.

RBI has also allowed HB to calculate the adjusted net bank credit considering one-third of the outstanding loans of HL as on the effective date of the merger for the first year.

The remaining two-thirds of the portfolio of HL will be considered over a period of next two years equally. This will help HB to manage its Priority Sector Loan (PSL) requirements more effectively – both operationally and financially. (According to RBI regulations, 40 percent of a bank’s total lending portfolio should be towards PSL. Of this 18% is required to be towards agriculture)

Merger is expected to complete by July 2023 – well within the original indicated timelines.

The merger will be effective July 1, 2023; 15 months from the date of the announcement.

HDFC in an analyst meet has pointed out the possibility of a worsening of net interest margin (NIM), net worth and asset quality in the short term following the merger.