The event was widely anticipated since 2019, when Larsen & Toubro (L&T) had bought a majority stake in Mindtree – termed as India’s first major hostile takeover.

Key points to note –

- L&T currently owns 60.99% of Mindtree and 74.05% of Larsen & Toubro Infotech (LTI)

- Given the common parent and similar business, the merger was anticipated for long and hence it’s not a surprise.

- Mindtree will be merged into LTI and the merged entity will be renamed as LTIMindtree Limited

- Shareholders of Mindtree will receive 73 shares of LTI for every 100 shares of Mindtree. This is in line with current respective share prices of LTI and Mindtree and hence there is no real advantage/ disadvantage to any

- L&T will own 68.73% in the combined entity

- Mindtree’s CEO Debashis Chatterjee will head the combined entity. LTI’s CEO and MD Sanjay Jalona has resigned. Exact reason for his resignation is anybody’s guess. LTI has simply attributed the resignation to his personal reasons.

Rationale for merger –

As mentioned before, common parent and similar business.

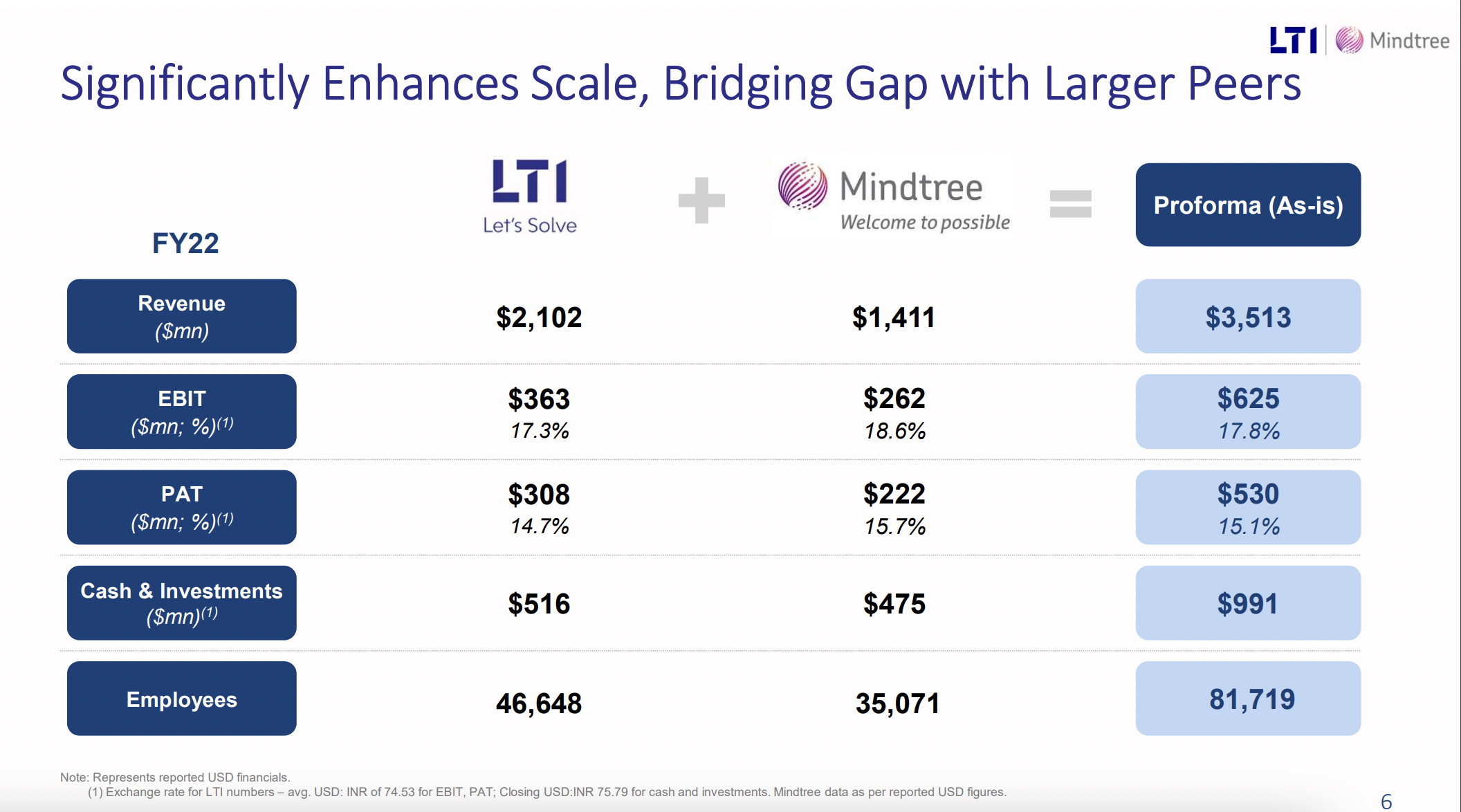

The combined entity will obviously have larger scale.

Does it make sense to buy only based on this development?

To me – No.

Yes, the scale will become bigger and hence also the competitiveness and the positioning. This should be beneficial over the medium to the long term.

However, the merger would also mean lot of reorganisation and associated implications in the short term.

I would rather relook fresh, once everything concludes.

Current valuations for either of the entities anyways is not attractive.