Restructuring/ consolidation continues at Raymonds.

It has taken further key decisions –

1. The associate Company, Raymond Consumer Care Limited (RCCL), sells FMCG business to Godrej Consumer Products (GCPL).

-

- The divested business include condom brands KamaSutra and Premium and deodorant brands Park Avenue and DS. Raymond’s condom plant in Aurangabad, Maharashtra, will continue to do the contract manufacturing for GCPL. Deos Raymond was sourcing from other contract manufacturers.

- Transaction is at a Cash Consideration of Rs 2,825 cr i.e., at 5.4 times annual FY22 sales of Rs 524 cr

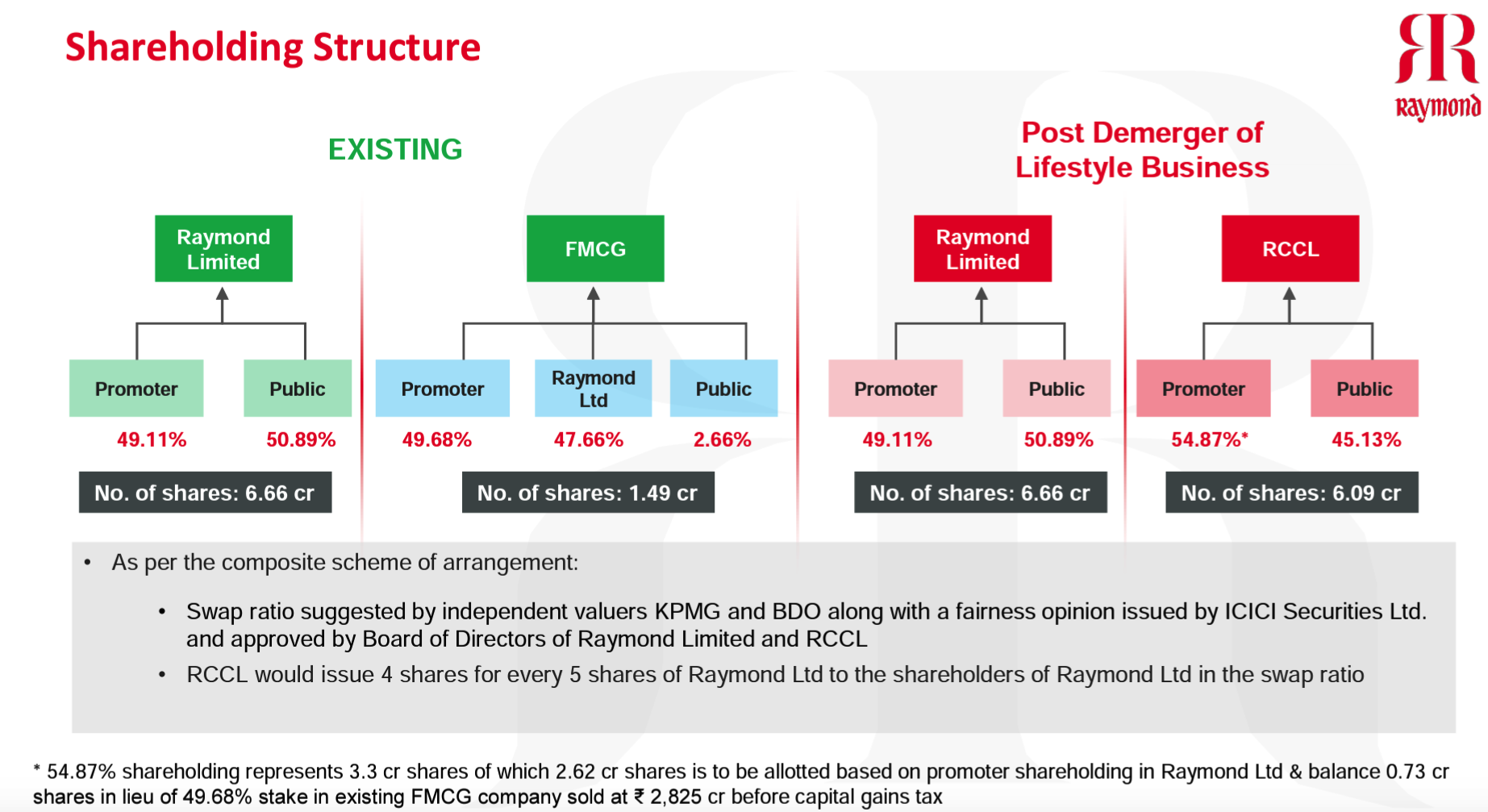

- Entire proceeds will be utilized to repay debt. Post tax receipts are estimated at Rs 2,200 cr. Promoters are plouging back their entire sale proceeds into the group and with this transaction have invested Rs 1,400 cr into Raymond group. (please refer the pre and post group shareholding pattern below)

-

- Raymond Group will be net debt free with ~Rs 1,300 cr surplus cash available as growth capital (Raymond Consolidated Gross debt was Rs 2,022 Cr & Net debt Rs 932 Cr as at December 2022 end)

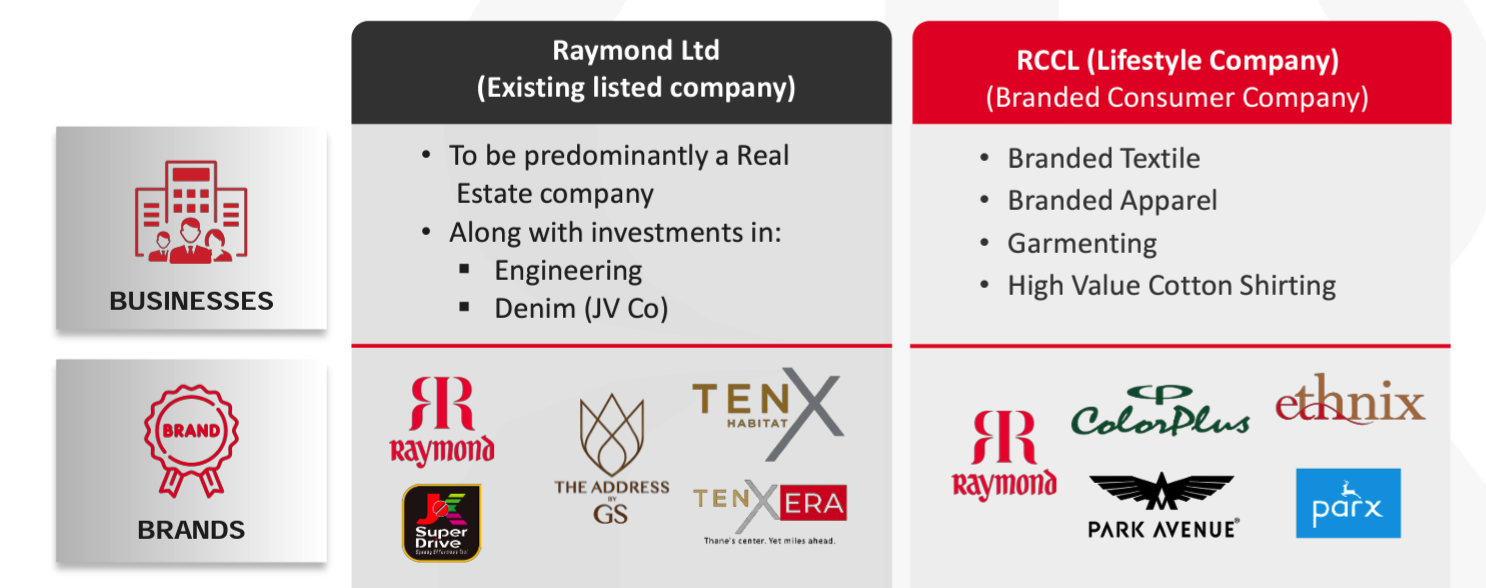

2. Demerge lifestyle business into RCCL and list it separately.

-

- Each Raymond Ltd shareholder to get 4 shares of RCCL for every 5 shares held

- The current company. i.e., Raymonds to be a real estate company with investments in engineering & denim business

Raymond’s exit from FMCG business seems to have come at a good price. That in turn implies an expensive buy for GCPL. However, given the small size of acquisition and the popularity of the acquired brands, I would not be concerned for them as well.

Overall, a deal that seems to be a win-2 for both.

Growing categories, good brands.

People seem to be getting warmed up to the acquisition and believing in Godrej’s ability to ramp up the growth of the acquired brands.