Reliance is unstoppable for now. It’s launching/ acquiring/ partnering businesses across segments and industries.

As part of it’s retail expansion strategy, the subsidiary Reliance Retail Ventures Limited (RRVL) has now entered into the beauty segment.

- Launched with an Omnichannel strategy combining both the online and offline route

- Tira website and app for ecommerce

- 1st physical store located at Jio World Drive, BKC Mumbai. Plan is to open stores across 100 cities over the next several months

- Tira offers wide assortment across categories. Brands include global, domestic as well as in-house private labels.

- Given the need of the category, Tira’s online platform showcases shoppable videos, blogs, tutorials, trend-setting tips, personal recommendations and a virtual try-on feature for consumers to try from the comfort of their homes.

- Likewise, Tira store will have latest beauty tech tools such as virtual try-on to create customised looks and a skin analyser that will personalise and assist consumers to make purchasing decisions based on their needs. The focus will be on curated services provided by trained Tira beauty advisors.

ED of RRVL, Isha Amabani commented –

“With Tira, we aim to break down barriers in the beauty space and democratise beauty for consumers across segments. Our vision for Tira is to be the leading beauty destination for accessible yet aspirational beauty, one that is inclusive and one that harbours the mission of becoming the most loved beauty retailer in India”.

Key notables

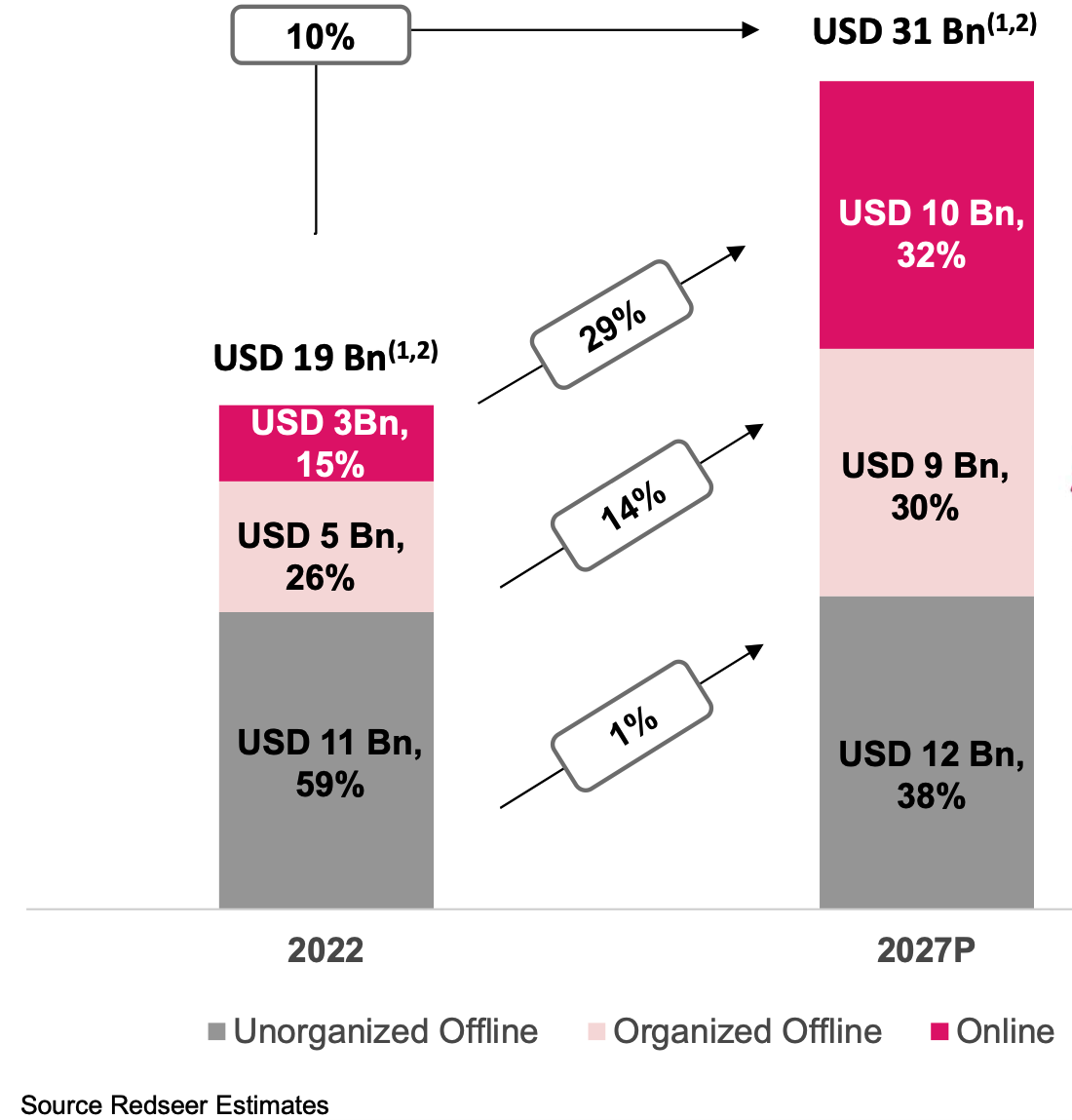

- Indian Beauty and Personal Care Industry – current size and projections

- Like any other industry in India, it’s projected that there will be a significant shift from unorganized to organized and within that ecommerce.

- I personally may not agree with that given the past experience across so many industries. The organized industry might increase more than the unorganized but not with such a significant difference of 14% vs 1% and ecommerce at 29%.

- Within organised, the segment is currently pioneered by Nykaa. It has good online presence and also has physical network of 135 stores and 37 fulfilment centres. The Company plans to expand its retail store network to 300-350 stores across 100 major cities over the next 2-3 years.

- Nykaa’s current market share in the total industry is estimated at 4-5% and within organised 9-10%.

- Other ecommerce majors including Amazon and Flipkart also sell beauty and personal care products.

- Also the large departmental stores including Shoppers Stop, Lifestyle have a significant presence in this space.

Given the industry size and current low organised sector penetration levels, Reliance surely has a good opportunity to grab a decent piece.

My only concern is how far and wide Reliance is spreading itself across so many different industries and segments. I would be keenly waiting for the businesses to get demerged and see individual performances with clear leadership/ succession strategy.

Agreed. Reliance need to demerge Retail and show individual performance. They are leveraging their 40-50 cr jio user base for all digital play and maybe that’s why they are not demerging. But with so many new retail verticals, demerger is important now. Infact, as a listed company, they should start financial reporting of each retail vertical separately.