Shriram City Union Finance (SCUF) stock has been a significant under performer since the beginning of 2015. Stock is currently trading at about Rs 2,300 compared with Rs 2,042 in January 2015 and the all time high of Rs 2,396 in October 2016.

This is an NBFC that is significantly exposed towards the auto sector and has consequently moved in tandem.

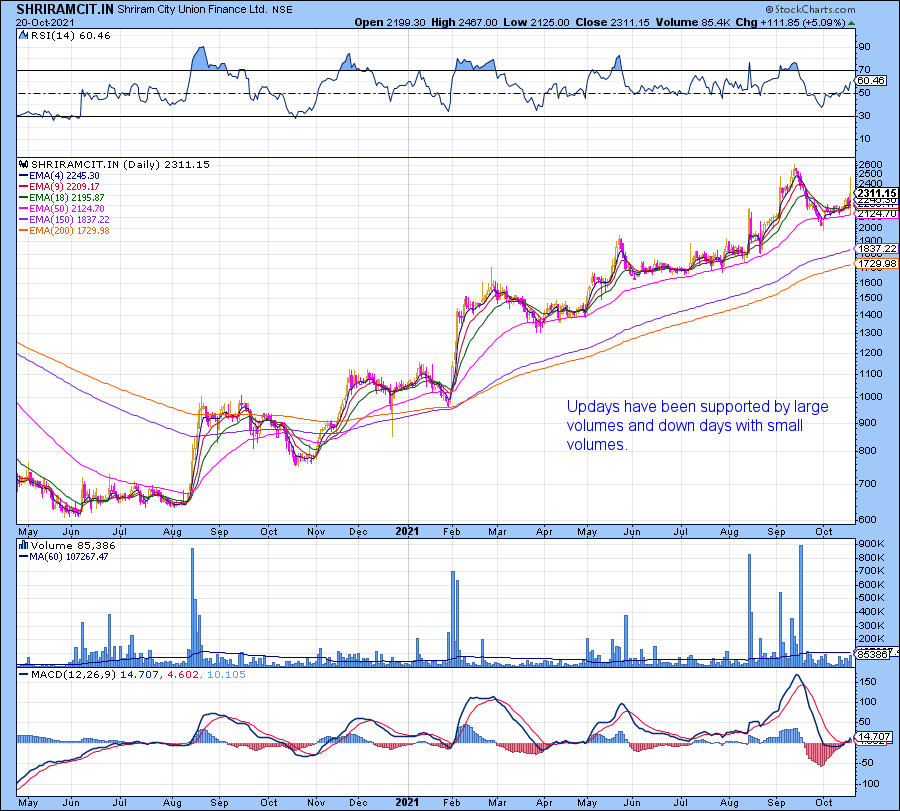

The stock saw significant correction during Covid led meltdown and reached a low of Rs 609 in May 2020. All NBFCs had fallen similarly during this period due to the underlying uncertainty of the economy and the repaying capability of the borrowers.

Since then though the stock has recovered significantly (almost 4x of the lows) but still has only reached it’s previous highs as mentioned above.

The stock seems to be setting up for further upside. Reasons –

- Auto sector in general seems to be much more positively placed now.

- The Company seems to have managed the Covid led uncertainties well and the book seems to be well under control.

- Company’s housing finance subsidiary seems to be performing better than expected and there is a potential value unlocking that might happen (separate listing)

- Fundamentally, the valuations are not over the top. Trailing twelve months P/E is reasonable at 14x.

- Float is extremely low. Retail is just holding 3% of the Company and hence any move can be very quick.

- Technically also the stock is giving all indications of a multi year breakout.

Taking everything into consideration, it surely seems an interesting stock to watch.