A serious stock investor spends a significant part of his time and bandwidth in selecting the right stock.

The selection strategy might differ from person to person, but the objective remains same – generate maximum returns while try minimizing the underling risks.

Practically though, returns get much more attention compared with the risks

and this is especially true in a bull market… like what is happening currently !

Even otherwise, risk as a topic in general has been addressed very vaguely or technically. E.g.,

- Don’t buy something that is overvalued/ has low margin of safety – this is vague and relative – most wealth creators over years have been overvalued. Yes, one can wait for steep falls to buy – but at that time most of us in any case are too fearful to invest. Otherwise, disciplined investors doing this would be minimizing risk to a very large extent.

- Check the beta of the stock – let’s pass – it conveys nothing frankly.

- Adjust return expectation/ discount rate with the underlying risk – again, as vague as it can get.

- Don’t invest if you don’t understand a sector – agreed and it’s a valid suggestion. However, even when I understand something, how do I know if my understanding is comprehensive and am not missing something important. Am not running the Company and maybe there is something that I don’t know.

Assessing risk has never been easy and will never be

Idea of this post is to try providing some key checks to try minimize the overall risk – or I should say – try avoiding a big mistake. You can even call them Hacks !

They have saved me multiple times – see if they make sense to you.

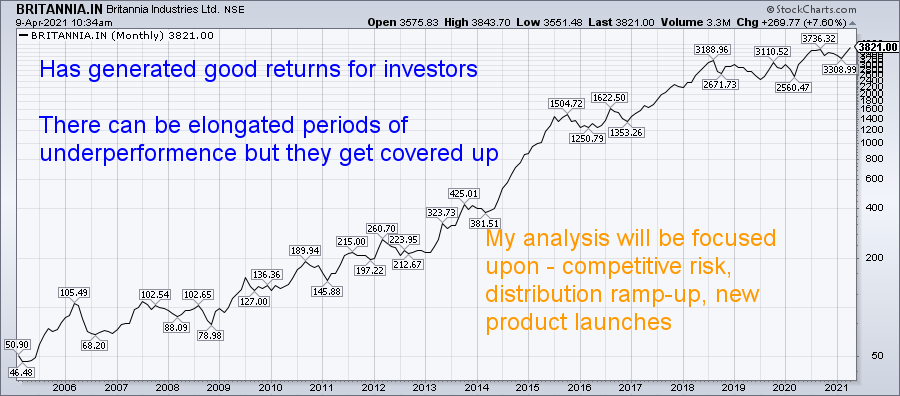

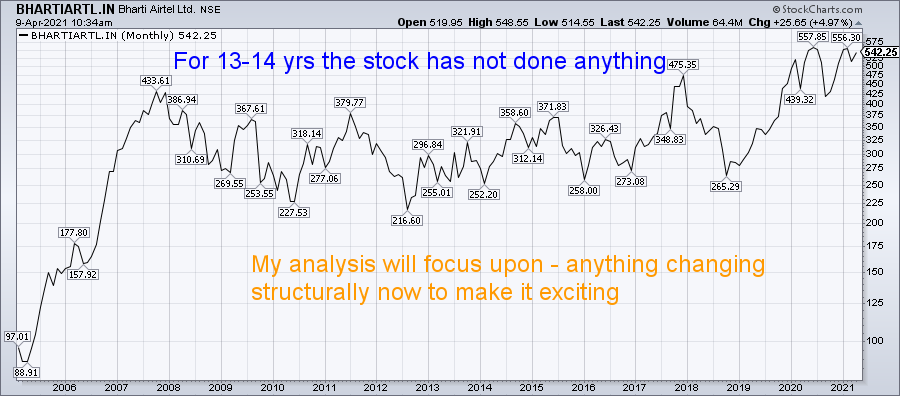

1. Long term chart of of the stockOver years I have realized this to be one of the most effective tools.

Long term chart of a stock reflects investor’s experience with the Company over the years

My base starting presumption is that the experience will continue and then I start looking at the reasons for it to change in future.

- Whether the growth story can continue; or

- Whether it’s a turnaround case

Checkout the following examples.

Long term chart helps me in creating an overall impression about the Company and it in one snapshot conveys the historical management quality and business dynamics.

2. My View vs Market ViewContrary to popular perception, I start with the presumption that –

Markets are efficient and are pricing the stock correctly

If my initial analysis is indicating that the stock is available at an attractive price, I try to find the reason why market is not recognizing it. Is there something that I am missing !

Say a stock is available at a low PE with decent return ratios and seems to be significantly undervalued vis-a-vis industry peers. I assume that this can’t be just due to market inefficiency and there has to be a reason for the same. I would then start looking for major red flags.

This approach has saved me from some big mistakes. It has thrown cases like –

- Siphoning of money through international entities

- Poor capital allocation practices by the management

- Consistently declining margins

- Saturation in market share

- Increasing competition etc

However, if there is no major red flag and it seems that the issue is temporary (e.g., Covid related impact on an otherwise financially sound Company with good business), I rely on my analysis and go ahead and buy.

3. Something that I just hate and cannot demystifyOne cannot pick up every winner. I try to pick the ones without any major red flag.

Every stock analysis will throw positives and negatives and that’s fine. Finally, one outweighs the other and investor decides to buy or not.

However, there are instances where one negative factor is so strong that you just don’t want to take a chance. I have my set of rules on this based on my experiences over the years and you will have yours.

Sharing some of mine as examples –

- Everything is always good in management talks and there seems to be no risks in the business (Company seems to have achieved Nirvana)

- Management loves to make appearances on TV channels for smallest of the announcements and seem to be available to journalists on tap (don’t know when do they focus on business)

- There are just too many inter dependencies between related entities in the group (poor auditors)

- Company has a habit of giving long term vision statements (will revisit when visions are achieved)

- Stock is the talk of the town as next multibagger (happens when story is nearing the end of the current upmove)

Above, is only an indicative list and is personal to my approach. You will have to figure out yours.

4. Market cap of the CompanyBull market/ upmove in a stock can push the market caps of some stocks to ridiculous numbers

I have seen this so many times. Even in the current bull run, this is true for many stocks.

It’s startling to just compare the market caps of some unproven companies with the ones with proven track record.

Most of the times, it happens when there is a strong tailwind to some underlying theme – global trends, government policy push, private equity valuations.

E.g., because technology/ app companies (e.g., Amazon, Facebook, Google, Swiggy, Byju’s etc) are valued high currently, there is a rush towards technology companies in India and we don’t want to differentiate between product and service companies !

As the excitement will subside, the mean reversion is bound to happen.

We all would have seen similar experiences with – Unitech, Bartronics, Vakrangee etc etc etc

Agreed, that in some businesses earnings can catch up very quickly. If that’s the underlying presumption, then it’s fine.

However, keeping a check on the overall market cap can surely help in doing a reality check.

Though in the process, one is bound to miss on some operator driven rallies 🙂

We can never be 100% sure of any investment and despite taking every precaution, mistakes are bound to happen. However, the idea should be to minimize the damage due to those mistakes.

Above have helped me reducing mine. Hope you also found them useful. Please do add other hacks in the comments based on your own experiences.

Some other interesting articles you may find useful –

- Management commentaries and what I make of them

- Stock picking is not the key… Capital allocation/ management is !

- Stocks: when to sell? – Part 3

Disclosure: Above are my personal opinions and not any recommendation. The reader should do his own research before making any investment.

Illustration Credit: Vecteezy.com