Part 1 – Recap

Link to my first article on the subject highlighting the importance of selling and how less attention it gets when compared to buying.

You ask any experienced stock investor/ trader and the only stories you will ever hear are the opportunities that he lost – not because he couldn’t identify and invest but because he exited either too soon or kept on holding it for too long !

Key characteristic of highly successful investors – they time the sell better than the others

For details and examples, kindly refer the above link.

Part 2 – How to sell better?

“Knowing yourself is the beginning of all wisdom” – Aristotle

Whatever I am sharing below is based on my own investing experience and observations since 2001. I should accept here that ‘not being able to sell right’ has been a key obstacle to my investing performance over the years.

It’s only in the last few years, once I became a more active investor that I decided to sit, self reflect and try to figure out the reasons for not being able to sell right.

I found out that I was not selling right because I was confused and over confident/ lazy.

- Confused as to what kind of a investor I was – although I was calling myself a fundamental investor, many a times I acted as a short term opportunistic investor/ trader.

- If investment worked in my direction (e.g., Bajaj Finance), I exited quickly at small profits and missed most of the upmove

- If it didn’t work in my direction, I kept sitting on it for years’ (e.g., Geodesic)

- Over Confident and/ or lazy that I can not be wrong in my analysis

- Ignoring market’s collective wisdom and hence accumulated duds e.g., Jagran Prakashan

If you want to sell right – be self aware

Be aware about your own aptitude and skill set and more importantly the reason for buying into any particular investment.

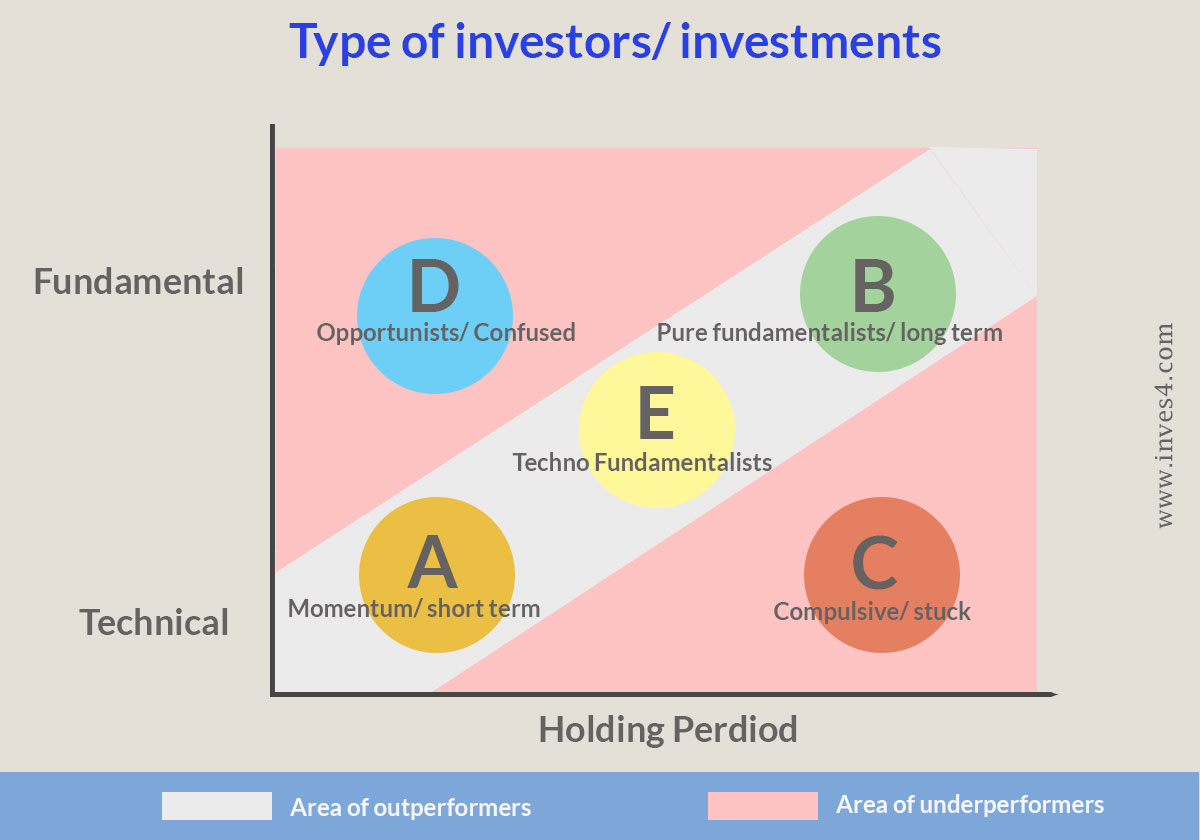

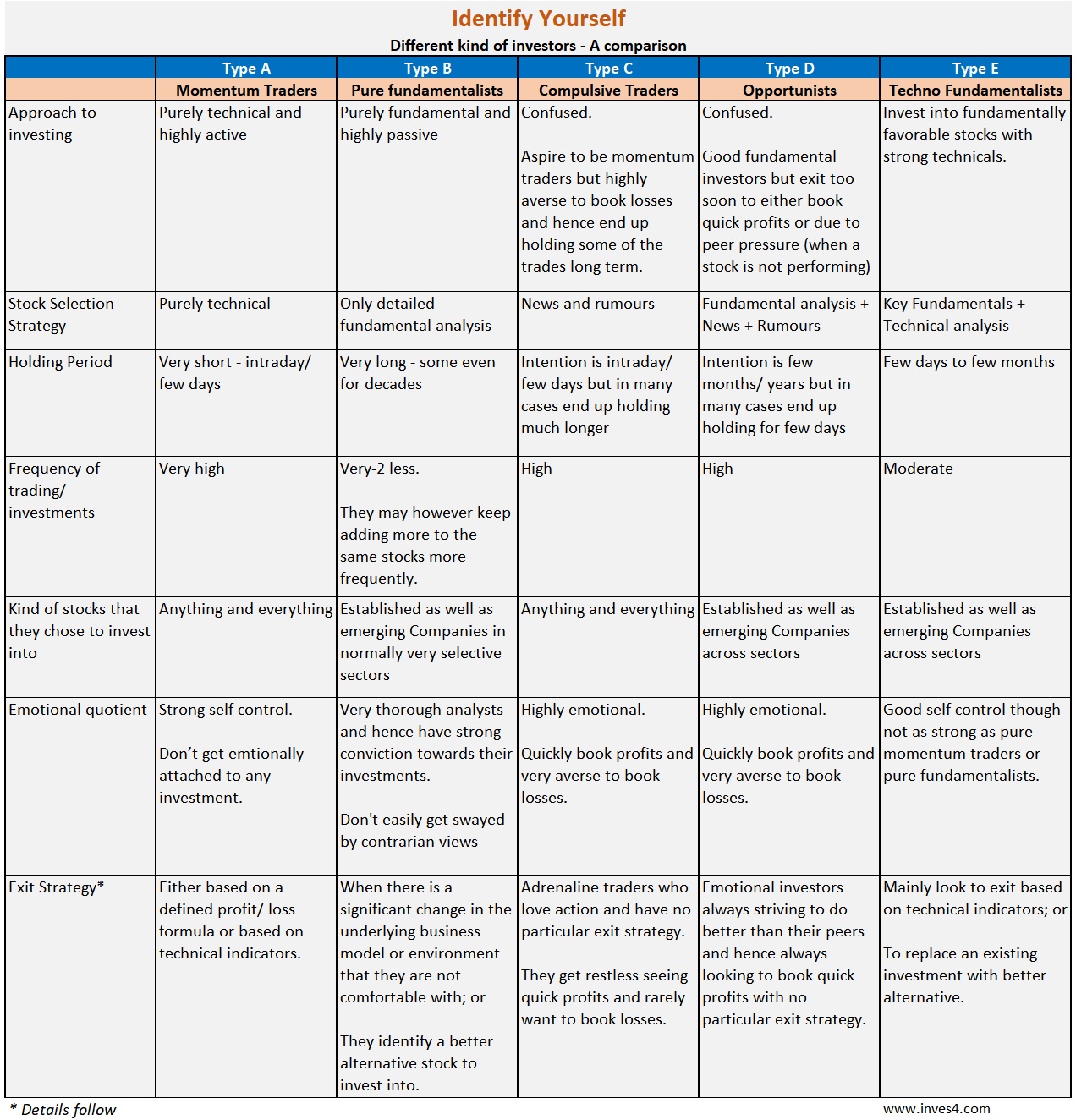

Do spend some time going through the above and check for yourself what kind of investor/ trader/ speculator (used interchangeably) you are?

It’s THE most important step to try to sell better. The strategies discussed in the next section would be difficult to adhere to if one is not aware about his own aptitude, style, strengths and weaknesses.

I agree and understand that sometimes practically it might be difficult to do a clear demarcation in style but check again… isn’t that precisely what Type C and D are !

The effort should be to try to graduate away from C & D towards A, B & E

Strategies to sell better

Two important points to always keep in mind –

- You can never catch the top – and hence never regret if you miss an upmove after you sold out; and

- Every chosen stock of yours will not yield you profits – you are not the market but only an individual, who can be wrong !

Detailed below are the exit strategies based on what kind of an investor you are:

If you are Type A – Momentum tradersThe biggest strength of yours is that you know you have equal probability of picking a winner vs loser i.e., trade that will yield you profit vs trade that will incur you a loss. You therefore always strive to be disciplined about stop losses.

Formula based exit strategy

Determine a target profit % which is ‘atleast’ twice of the stop loss % e.g., 10% profit target vs 5% stop loss, 15% vs 7.5%, 20% vs 10%

Exit either when the target profit is achieved or the stop loss is hit.

Yes, there would be times when neither are getting hit and it’s getting frustrating or you have gap down openings or sudden falls. However, improvisations in stock picking abilities over time should mitigate these occurrences.

Technical indicators driven exit strategy

There are 100s of technical indicators and every momentum trader has his favorites. One or a combination of few of these are used to set trailing stop losses and identify overbought zones to exit.

Some examples:

- Will exit when stock’s 4day EMA crosses 50day EMA on the downside

- Will exit immediately if RSI enters the overbought zone and 4day EMA is still below 200 day EMA

- Will exit when the stock price breaches the lower upward sloping line of the trend channel

The idea here is to try catching a significant part of the short term trend.

If you are Type B – Pure FundamentalistsYou have strong analytical abilities to identify focused businesses with moat (strong competitive edge). Hence, you should be ready to hold stocks for years if not decades and should not bother about short term fluctuations.

This however doesn’t mean that one should be complacent and not keep ear to the ground. Exit for these investors can happen in either of the two situations –

When the underlying thesis becomes doubtful

It can happen for various reasons. e.g.,

- Significant management change;

- Diversification into an unrelated business;

- Entry of a strong competitor;

- Saturation of overall market and hence growth rates;

- Increased government regulations;

- Over aggressive expansions/ acquisitions etc

Here it’s important to differentiate between industry headwinds and Company specific headwinds. Industry headwinds can be short term in nature whereas Company specific can be permanent. Hence, fundamentalists would only look to exit in case of the latter. E.g., Auto – lot of fundamentalists would not have exited stocks like Maruti, Bajaj Auto, Hero Motors in last couple of years as the headwinds were for the whole sector and not any of these specific stocks. However, at the same time many decided to exit Eicher as they felt that it’s inherent moat of Royal Enfield motorcycles is reaching saturation and is also facing increased competitive challenges.

When you have identified another stock to replace

Every portfolio needs to have some defined number of stocks. Number would depend upon your own risk aptitude and the capital at play. Higher the risk aptitude, lower the number… and higher the capital at play, higher the number (a related article – Stock picking is not the key… Capital allocation/ management is)

One can not just keep adding every identified stock. Hence, you may want to exit out of a stock to replace it with another stock. This can happen both because of –

- Sector related churn – e.g., you want to replace infra stocks with auto and pharma stocks

- Company specific churn – e.g., you want to replace HDFC Bank with ICICI Bank

They invest in fundamentally strong stocks based on technicals.

Their exit strategy is also technical indicators driven – similar to that of momentum traders. However, the time frames are longer – weeks and months.

They also mostly like selective stocks and hence may enter and exit the same stocks again and again.

If you are Type C & D – ConfusedYour first target should be to exit the current type and try becoming A, B or E and then accordingly improvise the exit strategy !

Selling is never easy and one can only target to improvise with time. Even after spending almost 20 years, I consider myself a very average seller and continue to improvise.

What one needs is continued introspection and learning. I hope to have provided you with sufficient material to think through.

I do understand that you may still have lot of questions on the subject. Please feel free to ask them below in the comments section or send them at nitin@candidcap.com. I will try my best to revert back.

I do intend to continue writing more on the subject – so keep a watch…

Illustration Credit: Vecteezy.com

Very well written and explained. Simply superb !!!