As they say…

It’s easy to get in and difficult to get out

Over the years, I have realized – stock picking is over rated and selling (at the right time) is ‘highly’ under rated !

Let me clarify, I am not saying that investing in the right Company is not important. It is very important and is the base of any investing activity, however, the following facts remain…

- Tons of material is available to learn the entry part. We all have been learning to analyze Companies since school days and still continue to do so. Hot topic for discussion in every forum (or web conference nowadays) continues to be… which is the good Company to invest into?

- Yes, our ability to identify good investments has improved over time but think carefully… are we perfect or will we ever be ? I am not aware about anyone who has been able to prove so ! In fact, as per me, the ability of anyone to pick winners ranges in between 40% to 60%. That is 4 to 6 winners out of every 10 stocks that he chooses. I don’t know anyone who is better than 60% !

- Given that businesses operate in a dynamic environment, assumptions to invest that hold true today might not hold true 6 months down the line (forget about 6 years after).

So if neither can we be perfect and nor the environment allows us to be over confident, doesn’t it make sense to put equal (if not more) focus on selling as well? Though, I personally believe selling is actually far more important than buying.

Now at this point you maybe thinking that this article is meant for traders and not deep value investors. Let me clarify – NO !

Selling is equally important for the value investors.

- By selling I am in no way referring to quick selling – holding for long term is also part of selling (at the right time)

- As regards quick selling and value investors – what better way to justify that then to highlight Warren Buffett’s recent exit out of the airline stocks. Contrary to his normal behavior of investing and holding for long term, the moment he decided that Covid2019 resulted in a structural change for the airline industry – he flew out ✈…. now pls let’s not get into the debate whether he was right or wrong… that’s not the point here !

One of the key characteristic of highly successful investors – they can sell out better than others

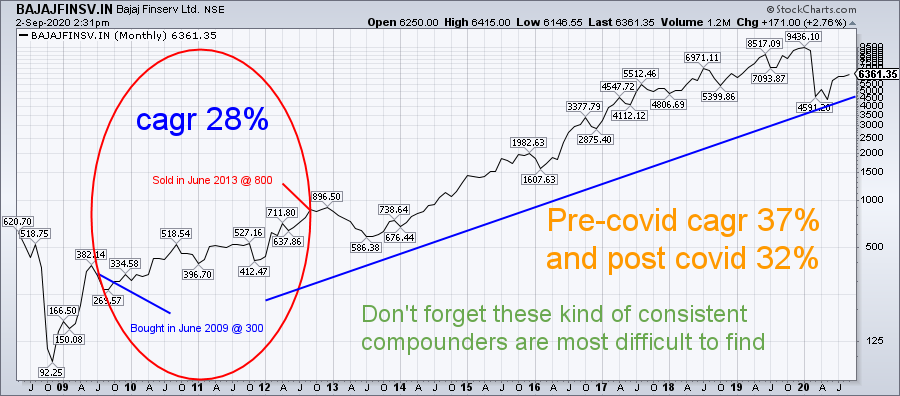

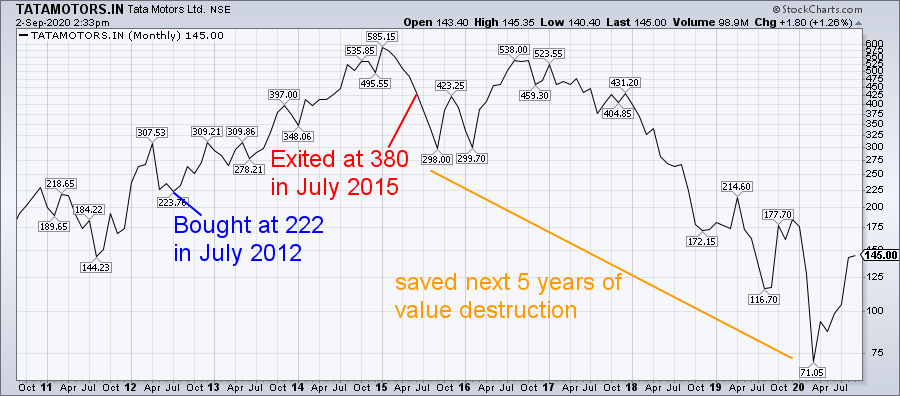

Look at the following examples to further understand the importance of selling –

Above are just some examples and there are many-2 more. All of us know what happened with likes of Unitech, DLF, ADAG group companies, DHFL, Yes Bank and so on and on and on…

At the same time many of us bought and quickly exited Companies like Nestle, HDFC Bank, Kotak Bank etc. These are precisely the stocks that one should have been instead holding for long term.

So in some cases we were too keen on booking profits when we should have been holding them for long and in others we waited and waited and waited… when we should have actually exited fast !

So, what should one do to address this in future?

It’s a process and let me warn you – not a easy one !

If you are hoping that someone has a magic formulae that you can copy and paste, you will be disappointed.

One needs to take baby steps… walk… fall… stand again… try walking better next time… and keep improvising…

Given the importance of this subject, I have decided to divide this topic in multiple articles, taking one step at a time so that all of us give it sufficient time to think through.

For the time being, spend some time going through the above and relate it with your personal investment experiences. I am sure there would be many similarities.

I will consider purpose of this article served if I have been able to push through the importance of selling !

Before concluding, let me give you further food for thought on why we actually sell…

- To recover our capital from a stock that was a laggard for many years;

- Book quick profits (and rarely losses);

- Loss of faith on business prospects;

- Valuations becoming expensive;

- Reading too much and getting unnerved by unavoidable fluctuations in the quarterly results (ok ok, not everyone is HDFC Bank);

- Over confidence of being able to continue finding new opportunities; and most important

- Peer pressure – our stock under performing via-a-vis our friend’s who seem to have hit a jackpot of investing into a 100x candidate and is on the road to become a billionaire !

At this point let me accept – I have exceeded my self imposed limit for this post…

Picture abhi baaki hai doston !

Disclaimer: Above are my personal opinions and not any recommendation. The reader should do his own research before taking any investment related decision.

Illustration Credit: Vecteezy.com

Bhai kahaani start hone se pehle hi close kar diya…anyway will wait for next update on this

great article Nitinji….will wait for the next season…