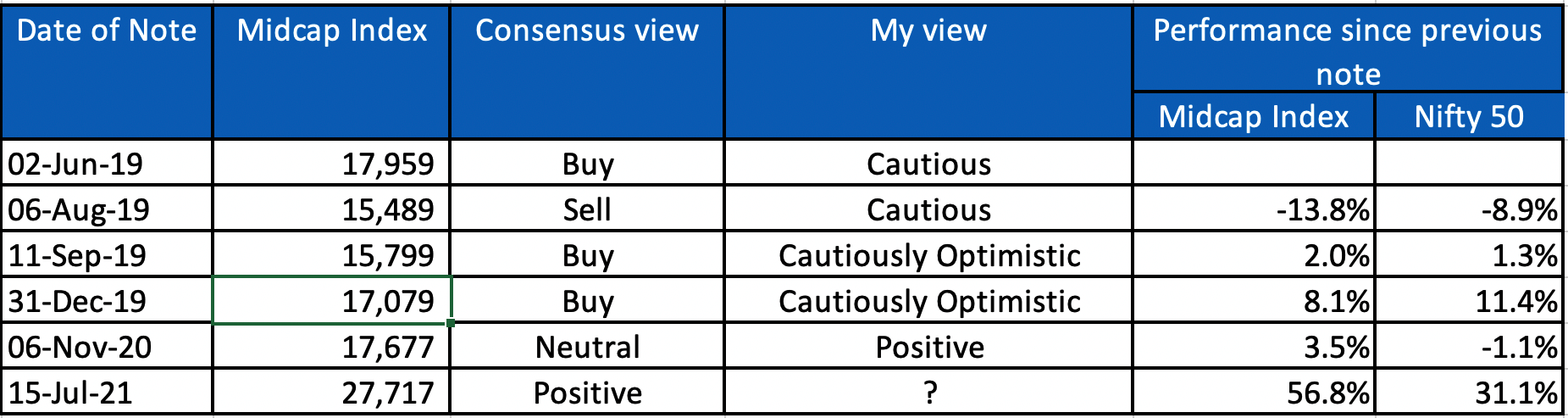

My previous posts on the topic –

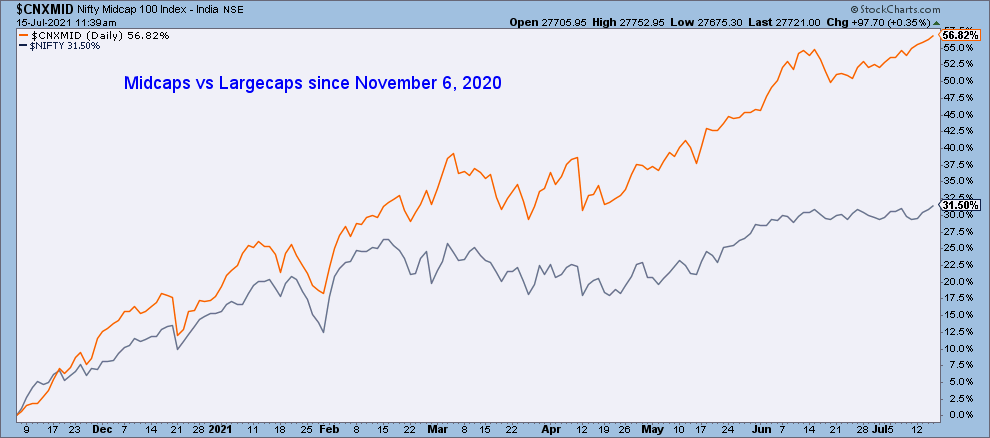

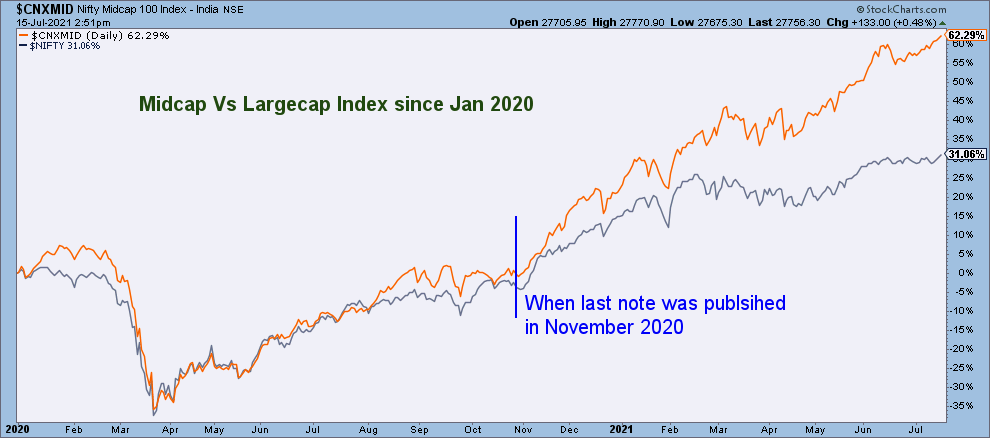

Midcaps have significantly outperformed large caps since my last note in November 2020. Have a look at the following performance comparison chart.

The performance has exactly been in line with my expectations.

It may also be pertinent to remind here that this was not the consensus view then – most people were cautious on the overall market expecting steep fall and were hoping midcaps to at best perform in line with the large caps. This was primarily due to the significant run up that had already happened in the overall market since March 2020.

So what exactly happened and what were the reasons for the outperformance? Were they in line with the reasons for my optimism?

I would tend to believe so !

Midcap outperformance obviously means increased risk appetite of the investors and that seems to have happened because of the following key reasons –

- Abundant global liquidity

- Commodity bull cycle

- Less than expected Covid impact on the economy

- Better than expected results by majority of the Indian corporates

- Revival in core sectors including Auto, Real Estate

- Favourable valuation metrics of the midcaps – due to their under performance since 2018

I am sure, your views about the reasons for outperformance would not be very different from the above and these are also coincidentally similar to the ones mentioned in my November 2020 note 🙂

So now what? Can one expect midcaps to continue outperforming the large caps?

Let’s again try to look at the key factors.

1. Global Liquidity

This as such is not an issue right now. Liquidity continues to be abundant and to an extent where funds are getting parked with Fed at extremely low rates.

Easy liquidity card definitely seems to be getting overplayed but the problem is no regulator knows what to do about it – atleast not for now, as Covid has not vanished and continues to show it’s ugly face time and again.

What has definitely changed is – gradual creeping of caution in the mind of the large investors, whereby they are increasingly getting wary of a sudden jerk called “Black Swan”. Result – an effort to slowly reduce/ hedge risk.

However, this effort of theirs can at best bring some readjustment and is unlikely to reverse the momentum.

2. Economy and Corporate results

I am again not overly concerned by the economic performance and broadly we shall be ok. My comfort again stems from detailed views in the previous note related to the economy – COVID2019 is it a blessing in disguise for the Indian economy

However, what maybe important to note are the underlying expectations on financial performance by the Companies. In last 3-4 quarters, many companies have overdelivered on expectations and it may become difficult to continue doing so. Investors continue to build blue sky scenarios for many of these Companies.

Going forward, financial results will start looking much more rational due to –

- Inflation – raw material prices are increasing all across. This is surely going to impact demand (and hence sales growth) as well as profit margins.

- Low interest costs – most companies benefited on this in the last few quarters. Incremental benefits are unlikely to be significant. On the contrary, continued unabated inflation may prompt regulators to start thinking about tightening interest rates, albeit marginally.

The impact obviously would vary from sector to sector.

3. Valuations

These dynamics have surely changed.

Midcaps – 1 yr forward P/E multiple of 19-20x now compared to 14-15x in November 2020.

Large caps – 21-22x now compared to 19-20x then.

The gap has significantly reduced between large and mid caps and to that extent also the margin of safety. This would surely be prompting investors to start looking towards safer bets.

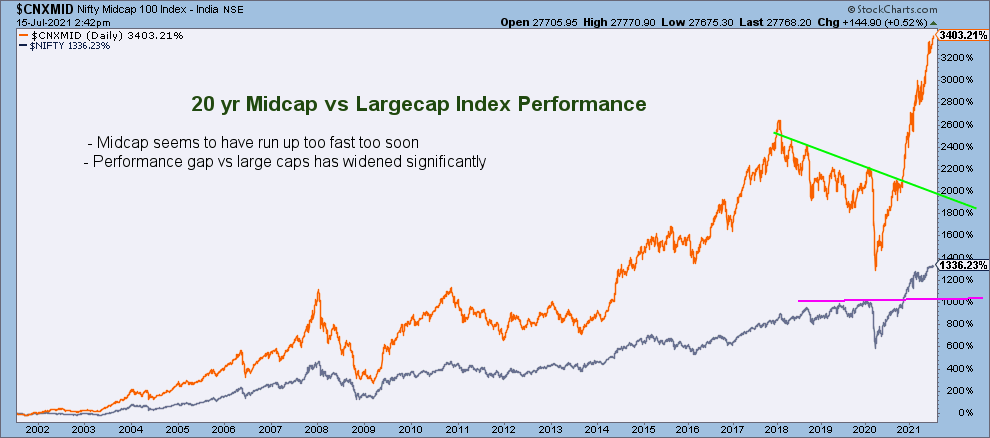

4. Technical charts

On longer and shorter time frames, midcaps seem overstretched. However, on medium term the performance is comparable and leaves significant scope for continued outperformance vis-a-vis the large caps.

Technically, it continues to be a momentum play. However, given the overstretch – with tight stop losses. This should be especially done for stocks with poor fundamentals and/ or valuation support.

5. Broad observations worth considering

These are my personal observations about the recent market and have played an important role in arriving at my final view about the midcaps. People connected with me on twitter will surely relate.

See if they make sense to you –

- During last 6-9 months of run up, a lot has been about Companies who could create FOMO. In the process many fundamentally strong stocks have done nothing and have in-fact corrected. Result – there are FOMO stocks that have run up too fast too soon and then there are Companies who keep on doing what they do best i.e., execution, though without getting much love from the market.

- People have started expecting market to be an easy wealth generator and hence are bullish on everything that they hear on media or through tips. This never works for extended periods.

- Investors are getting too much time to exit out of their long positions. This is not the trait of a market that wants to go into a deep correction.

- Many stocks seem to be tiring though not exactly giving an indication of topping out.

- Overall volumes have reduced significantly and institutions seem to be more focused towards rotation.

Considering all the above, I am turning “Neutral” on midcaps.

Too much too soon in selective pockets with high built-in expectations is making me cautious but absence of a significant negative trigger is prompting me to remain interested.

Given that I am not positive, ld mean I will turn my attention towards defensives. Valuations, business and management are anyways key to my positions – irrespective of the underlying market conditions !

Disclaimer: Above are my personal opinions and not any recommendation. The reader should do his own research before making any investment.

Illustration Credit: Vecteezy.com